According to the Bangko Sentral ng Pilipinas, only 3% of the population invest their money in stocks, bonds etc.!

This shouldn’t be surprising for most since most Filipinos reject the concept of investing. Some think that these are only for the rich.

While others think that investing is something done by old people with a lot of knowledge in stocks.

Let me ask you, do you have any investments? No, I’m not asking about your investments in networking companies or the likes. I’m talking about stocks, mutual funds, bonds and many more.

If you have a family and you have investments, then congratulations! You’re taking the right step to financial freedom. If you’re still single and already have investments, then I’m prouder of you!

But if you don’t have any SINGLE investment right now, it’s time to rethink your financial goals.

Especially since now, you can be an investor for as low as P50 thanks to GCash Invest Money! If you’re curious, read on below!

I suggest you read all the way down before you invest so you will have a full idea of what you’re going in to. (This is also because I don’t want you to blame me if you lose money! :D)

What is GCash Invest Money?

Now, you may wonder as to what is invest money in GCash. In short, GCash Invest is the investment feature in the GCash app. This is a partnership with Globe Telecom, Ant Financial and Ayala Corp’s Mynt and ATRAM Trust Corp. Together, they hope to make investing easier and accessible.

Currently, GCash Invest allows users to invest in ATRAM Trust Corporation which will invest the money to the ATRAM Peso Money Market Fund. And the great thing about this feature is that you don’t need to have a bank account to invest in.

What’s more, is that you can easily access your investments in the GCash app where you can also monitor the prices.

Here are the terms you need to take note of:

SUBSCRIBE – In simple terms, this is the term used if you want to invest money in GCash Invest. You will select this one to deposit money from your GCash balance to GCash Invest.

REDEEM – The term redeem is used if you want to withdraw your funds/earnings. When you withdraw your funds, it will return to your GCash Balance.

RISK PROFILE – If you’re familiar with stocks, you’ll know that brokers ask investors some questions before they invest. In GCash Invest Money, you’ll also be asked some questions before you invest. This is to determine how much risk you’re willing to take. Depending on your answers, your assessment would either be: conservative, moderate, or aggressive. If you have a lower risk appetite, the returns are usually low as well. But if you’re willing to take on higher risks, the earning potential will be high as well. That’s just the law of investing.

NAVPU – NAVPU stands for “Net Asset Value Per Unit”. In simple terms, this is the value of your investment when you buy them. For instance, you invested P1,000 in GCash Invest which would be equivalent to 25 NAVPU. After a year when you decide to withdraw your money, the NAVPU will also increase. It’s essentially a way to determine how many units of investment you bought.

GInvest Products

ATRAM Peso Money Market Fund

Minimum investment: P50

Past 1 yr. return: 0.50%

Fund Risk Rating: Conservative

This is the first investment product that GCash offered when they first introduced GInvest. Basically, this money market fund invests your money in fixed-income funds.

As of February 2021, they’re investing the funds in time deposit placements in BPI and RCBC as well as treasury bonds.

Because of this, there’s not much risk involved when investing here but don’t expect the return to be high as well. Overall, I suggest this product for those that are complete beginners in the world of investing as you can start with just P50!

ATRAM Global Consumer Trends Feeder Fund

Minimum investment: P1,000

Past 1 yr. return: 75.66%

Fund Risk Rating: Aggressive

If you’ve always wanted to invest in international stocks, this is one of the top picks! Personally, I’ve invested P2,000 in this product and I’m already seeing some profits after just a few days.

For this, GCash invests funds to stocks of international companies such as Alibaba, Amazon, SEA (Shopee), and Sony. These are top companies that are performing well right now in the stock market.

But as you’ve noticed, this is more suited to those that can take more risks as the risk rating for this fund is aggressive. This means that the stock prices go up and down regularly. Thus, your investment here is not guaranteed.

But the good thing here is that the minimum investment is only P1,000 and you can potentially earn a lot than from the money market fund.

ATRAM Global Technology Feeder Fund

Minimum investment: P1,000

Past 1 yr. return: 62.23%

Fund Risk Rating: Aggressive

Similar to the product above, the Global Technology Feeder Fund invests your money in international stocks such as Microsoft, Apple, Alphabet, and Samsung.

Because of this, the return is significantly higher but the risks are also high. You should only invest what you can afford to here since returns aren’t secured. However, I also invested an amount of P2,000 here and it looks promising.

ATRAM Total Return Peso Bond Fund

Minimum investment: P50

Past 1 yr. return: 2.87%

Fund Risk Rating: Moderate

If you’re looking for slightly higher returns than the money market fund but with less risks than international stocks, this is the perfect product for you!

Here, your fund is invested in Retail Treasury Bonds and Fixed Rate Treasury Notes. This means that your investments are government-backed and they offer steady growth.

ATRAM Philippine Equity Smart Index Fund

Minimum investment: P50

Past 1 yr. return: 14.35%

Fund Risk Rating: Aggressive

If you’ve always wanted to invest in Philippine stocks, then this product is a great option for you. Here, GCash invests your funds only in Blue Chips stocks so you can be at least assured that you can get returns. Here, the funds are currently invested in Globe Telecom, Ayala Corp, SM Investments, and Universal Robina Corp.

If you didn’t know, Blue Chip stocks are companies that have been proven and tested as they’ve been around for a long time. I suggest you read about Blue Chip Stocks more from our guide here so you can learn more – Blue Chip Stocks Philippines: Complete List.

How GCash Invest Money Works

GCash Invest is a feature of GCash that allows just about anyone to invest! That’s because the minimum investment here is P50! For a price of less than 1 milk tea, you can start investing in your future.

When you invest your money in GCash Invest for instance in ATRAM Money Market Fund, they invest this money into a portfolio of very liquid and fixed-income instruments. Their objective is to give higher returns compared to banks which typically give an interest rate of less than 1%.

The portfolio consists of investments in the money market, time deposits and cash. They indicate the percentage of the allocation of funds in the app so you’ll have an idea of how it all works.

With ATRAM, the interest rates range from 2% – 3% per year. This is considerably higher than banks with less than a 1% interest rate. But with the international stocks and local stocks products, you can invest and expect higher returns with higher risks.

That’s generally how the GCash Invest feature works. If you’re still unconvinced, you should read the next section about the advantages and disadvantages of GCash Invest Money!

Advantages and Disadvantages of GCash Invest

If you’re curious about whether GCash Invest is for you or not, read this quick guide:

Advantages:

- The minimum investment is as low as P50!

- Easy to sign up with

- No need for bank accounts/valid IDs

- No commission and sales fees

- Easy to withdraw funds

- Higher interest than banks

- Set up reminders to invest regularly

Disadvantages:

- Subscribe and redeem wait time: 2-3 business days

- Not advisable for trading/short term investing

As you can see, the advantages clearly outnumber the disadvantages of GCash Invest Money. In fact, these are not considered disadvantages. They are just some minor inconveniences.

Personally, I invested in GCash Invest as sort of like my emergency fund. This is because I would be discouraged by the wait time to withdraw (2-3 business days). And instead of just letting my money sit in the bank, I’ll get slightly higher interest rates!

How to Invest in GCash Invest Money

Investing in GCash Invest Money is easy. In fact, it’s so easy, it can be listed down in steps. Here are they:

1. Make sure that you have a GCash account first and you’ve downloaded the app. You also need to be a fully verified GCash user first.

2. Open the app and tap the Invest Money option. Just follow the instructions which will lead us to the next step.

3. Answer the risk profile test to determine your risk appetite. Make sure to answer honestly so that you’ll understand what you’re getting in to.

4. Then, agree to their Terms and Conditions.

5. They’ll send you an SMS verification that will say whether your application is approved or not. This doesn’t generally take longer than a day.

6. Once your account is approved, you can now invest in GCash Invest Money!

7. To invest, you need to have money in your GCash account. Note that you can already invest with a minimum of P50!

8. Then, just open the Invest Money feature and select “View Investment Products”.

9. Select the investment product you’d like to invest in. In the time of this writing, the only available product is ATRAM Peso Money Market Fund. Select it and then…

10. Tap the Subscribe button at the bottom and select how much you’re going to invest!

11. If it’s successful, you should receive a text message that says that your subscription is being processed. Your investment should reflect in 2-3 business days.

How to Withdraw in GCash Invest

After earning in GCash Invest or if you just want to pull out your investment for whatever reason, here’s the process.

1. Go to your GCash app.

2. Select the Invest Money feature.

3. Tap the View Investment Products.

4. Select your investment product (ATRAM)

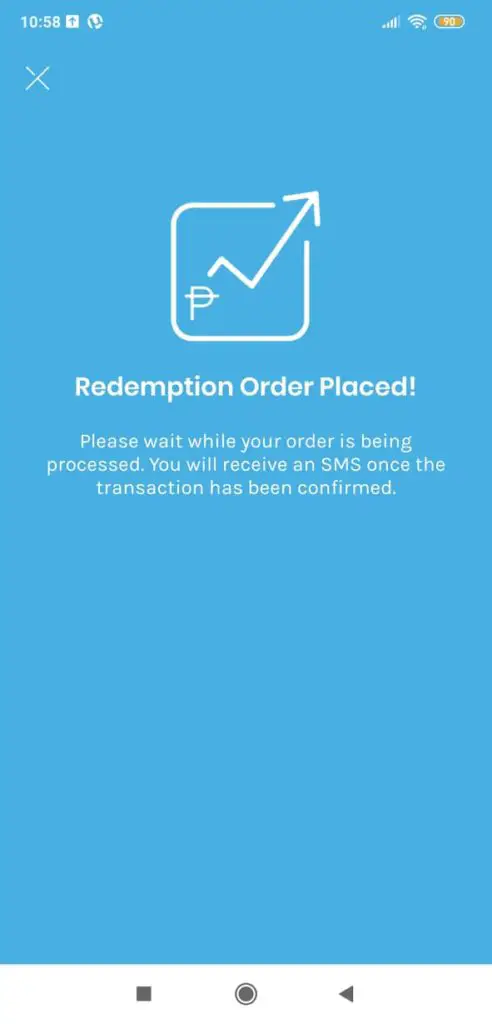

5. Tap the Redeem button at the bottom.

6. Input the amount which you want to withdraw.

7. Select the checkbox that says “I agree to the Terms of this redemption” and confirm your withdrawal.

8. That’s it! You should receive a text message confirming your withdrawal. The funds should arrive in your account in 2-3 business days.

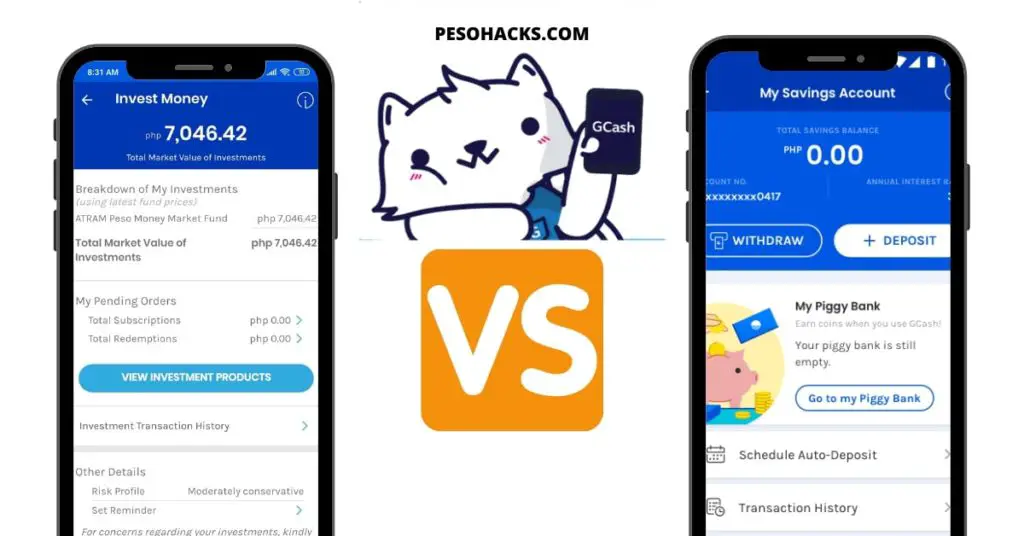

GCash Invest vs. GCash Save Money

This revolutionary feature that allows users to invest for as low as P50 is a sure hit for most people!

On the other hand, you may have heard about the GCash Save Money feature. In this feature, GCash has partnered up with CIMB which is a digital bank from Malaysia.

What’s so interesting about GCash Save Money is that it offers an interest rate of 3-4% annually! Because of this, you might be wondering, why should you invest in GCash Invest Money, when you can just put your money in GCash Save Money?

First of all, both features are more advantageous than traditional banks which offer only less than 1% interest rates.

But here are some key differences between the two in case you’re wondering:

- GCash Save Money offers interest rates of 3-4% while GCash Invest Money generally offers 3% or fewer interest rates.

- Save Money is a digital bank while the GCash Invest Money feature is for investments.

- GCash Invest Money focuses on short-term investments while you can park your money longer in GCash Save Money if you wish.

- Both are features of GCash.

- GSave is PDIC insured thru CIMB while GCash Invest Money is operated by ATRAM.

Looking at these, it looks like GCash Save Money might be better. However, they’re two completely different features of the same app.

Personally, I have money in both these features to diversify. And I use GCash Invest Money for my emergency fund because it doesn’t let me withdraw it instantly. I have to wait for 2-3 business days to withdraw so this discourages impulse withdrawals.

I also enjoy the GCash Save Money feature because it offers higher interest rates. At the end of the day, you can choose to invest your money on the two or one only. It depends on you!

GCash Invest FAQs

If you still have questions unanswered even when you’ve read all about GCash Invest Money, here are some Frequently Asked Questions and their answers:

Who can invest in GCash Invest Money?

Users must be 18 years old and have fully verified GCash account to be able to invest.

What documents do I need to start investing?

You don’t need to submit any documents unless you’re requested by ATRAM. Unlike other investment companies, you don’t need to submit any IDs or bank statements in GCash Invest Money.

How can I track my investments?

You can easily track your investments in the GCash app! Simply go over to the Invest Money feature! In there, you can see the total amount of your investments, investment transaction history, risk profile, reminders, NAVPU, and the price of the ATRAM Peso Money Market Fund.

How long does it take to invest/withdraw funds in GCash Invest Money?

After you subscribe or redeem, it’s usually indicated that the funds will reflect or will be available to you in 2-3 business days. In my experience, my investments are already reflected in less than 2 business days. The same is true when redeeming your investments.

What is the minimum amount to subscribe and redeem?

GCash Invest Money allows you to invest and withdraw money for as low as P50! This allows the masses to become investors easily because of this feature.

How will you receive your redeemed funds?

When you redeem your investments in GCash Invest Money, the money will go to your GCash balance after the order has been processed/confirmed.

To learn more about GCash Invest Money, visit their FAQ page here!

GCash Invest Money Promo

Most of the time, GCash features a lot of promos to encourage users to invest using this service. In the past they had promos that allowed you to get P50 cash back when you invest in GCash Invest Money for the first time.

They also had a promo where you were rewarded with a P100 cashback if you maintained your investments. But for now, there aren’t much. However, you should still invest and be updated as there might be some incredible promos in the future!

Bottomline

Investing is something that not a lot of Filipinos have easy access to especially students. This is why a lot of us still work even at the age of retirement (65) when we should just be enjoying the fruits of our labor.

However, that all changes as technology are advancing every day. Thanks to the GCash Invest Money feature, you can now invest for as low as P50! Now, you don’t have an excuse not to have any investment.

It’s a great starting investment for anyone striving for financial freedom. Just don’t get your hopes too high as the returns aren’t as high as in stocks. However, the risk isn’t as high compared to stocks as well. Just think of the money you invested in GCash Invest Money as emergency funds!

Recommended Reading:

7 Comments