Note: This is a guest post by Ameena from The Thrifty Pinay! Be sure to check out her blog for topics on investments, motherhood and all things personal finance! 🙂

Every master was once a disaster.

All of us have dreamed of being a master in a certain field. Probably, many of us have wanted to master one or two investment vehicles that will help in generating income that will pave the way towards financial freedom.

With a dizzying array of investment vehicles to choose from, where do you start? How will you know what suits you best?

If you ‘ve decided that you are ready to get your feet wet in the world of Investing, then you’ve come to the right place. Below is a list of the 10 Best Investments for Beginners in the Philippines this 2022.

*Make sure to read the 4 Things to do Before Investing at the end of this post!

1.Time Deposit

A time deposit is one type of investment vehicle that is almost risk-free which “locks” a specific amount of money in a certain period of time.

These are available in your local bank and are also called Certificates of deposit.

They pay higher interest rates than normal savings accounts in exchange for not being withdrawn for a specified time period.

In addition, the tenure or the “lock in” period can range from 30days, 60 days, 90 days to 5 years or more, depending on your chosen bank.

“What if I want to withdraw before the end of the lock in period?”

Your investment will be subject to fees and charges, depending on your chosen bank. That’s why time deposits are one of the best investments for beginners.

To compare the time deposit rates of each bank, CLICK HERE.

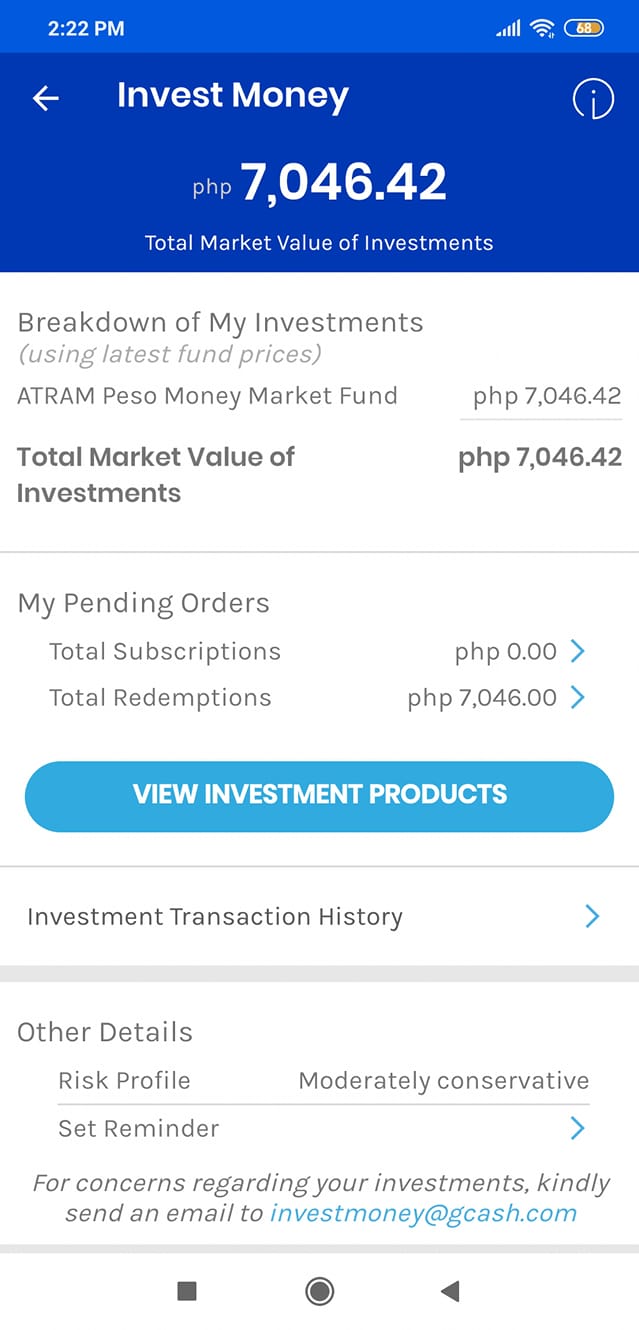

2. GCash

This next one is probably the best investments for begnners who don’t have much capital.

GCash Invest Money is the investment marketplace feature of the GCash App. With GCash Invest Money, you can begin building towards your financial goals with just Php50.00 which is relatively low compared to traditional investment platforms that request for at least Php1,000 as the minimum capital.

As of this writing, GCash offers ATRAM Peso Money Market Fund is what they offer. And for as low as Php 50.00, you can get to experience how investing works without risking a significant portion of your hard-earned money.

So, if you’re planning to kickstart your investing journey right now then this is your chance to do so.

GCash also makes it easier for investors as they can manage their investments all within the app, such as adding more capital, transferring them to a different mutual fund, or redeeming the investments.

Because of this, there’s no need for a physical appearance in banks. You only need to register for a GCash account and fill up a few documents through the mobile application.

Smart and Sun Subscribers can also register their numbers in GCash, so it’s cool that this app is not only limited to Globe Subscribers.

Once you register, you get an instant P50 reward and so will I! Already hyped up in investing? You may register with GCash through this link HERE.

Oh! And I also use Gsave to save a part of my emergency fund since they are offering an interest rate of 4.1% p.a. What a way to grow your savings! That rate completely outstrips the savings rates of traditional banks.

Moreover, I use Gcash to pay my bills and our SSS and Pag-ibig contributions.

See what a convenience Gcash is? Go ahead and register with Gcash through this link HERE!

3.Unit Investment Trust Fund (UITF)

UITF stands for Unit Investment Trust Fund and is a “collective” investment scheme that is offered by, if not all, by commercial banks. Focus on the word “FUND” because basically, that is what it is-an amount of money from many individuals that is pooled.

How do you earn from a UITF?

I want you to focus on the word “UNIT” because basically, you are buying units or shares from the bank in exchange for the money you will invest. That’s why there is the word “unit” in UITF.

The price of one unit is called NAVPU which is the acronym of Net Asset Value per UNIT. Notice that it also has the word “unit” meaning every unit you buy has a price.

Gains or losses are computed via NAVPU from the time you opened your UITF to the time you close or redeem it.

Every day, the NAVPU changes. On some days, it increases. On other days, it fluctuates. Why? It depends on the fund manager’s performance for that day. At the end of the day, if the market went well, the NAVPU is higher compared to the NAVPU yesterday. If the market went down, it is lower than that of yesterday.

To learn more about UITFs, CLICK HERE!

4.Mutual Funds

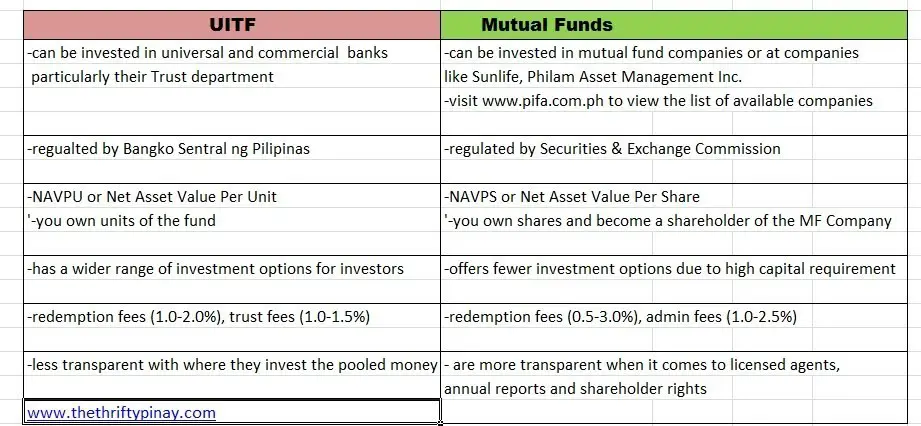

A mutual fund is a pool of money from the public that is invested . It is also called pooled or managed fund. Computing the gains and losses of Mutual Funds is very similar to UITFs which is mentioned above. However, they do have their differences:

To learn more about Mutual Funds, CLICK HERE.

5. Stocks

A stock is an investment that represents a share, or partial ownership, of a company. Stocks are one of the best ways to build wealth.

Ok. So, if you think that explanation is too vague, here’s another way to get a deeper understanding of Stocks.

To help you understand stocks more, I decided to explain it through a story:

Allan, Ben and Cath own a milk tea shop. Their company is a Private Company. It is a private company because the owners are only limited to a small group of people.

All businesses usually start as private. Then probably after a few years, when business is doing great, they might want to grow more branches and expand.

But Allan, Ben and Cath have limited capital for their expansion. So all three of them decided to sell a part of the company to other people. They can do this by offering people to invest in their business. Once people start investing in their milk tea business, they will have the necessary funds to expand their business.

So, they ask their friend Dan to buy a part of the business. So when they do receive money from Dan, they can use that to put up a new branch.

Now when their business thrives and earns money, the original owners (Allan, Ben and Cath) will no longer get all the profit for themselves because they have to share it with Dan.

Now Allan, Ben and Cath want to put up a hundred more branches, meaning Dan’s money won’t be enough for the expansion. Hence, they need money from more investors.

This is where their business, which is a private company turns into a public company. By being a public company, they can now sell part ownership of the business to the public and anyone who wants to have part ownership can invest money by buying shares.

Also, this is where the stock market comes in.

A stock market is a place where you can buy shares of public companies and become a part owner of those businesses.

1.Earn through Dividends

The income you get from those public companies is called Dividends.

A Dividend is a payment made by corporations to their shareholders, usually as a distribution of profits. As an owner of a company, you might share in the company’s profits in the form of:

- Cash Dividends – where payment to shareholders are made in cash

- Stock dividends -where more shares are given on top of what they own

To receive a dividend, you must own the stock by the ex-dividend date. If you don’t buy shares before the ex-dividend date, you will not be included in the list of shareholders who will receive dividends.

The company decides how much the dividend will be per share. The amount that will be deposited into your brokerage account is simply the number of shares you own multiplied by the dividend per share.

Shares owned X Div per share = Dividends

So, if you own 10,000 shares and the dividend is P0.50, the company will deposit P5,000 on the payment date.

2. Earn through Capital Appreciation

Let’s say a share in San Miguel Corporation (SMC) is currently worth around P200. So, if you want to be a part-owner of SMC, you need to pay P200 for every share you buy.

But wait. The stock market has rules. Supposing that you need to buy 10 shares of SMC before you can be a part-owner. This means you need to spend P2,000 before you become a part-owner.

To learn more about Stocks in the Philippines, CLICK HERE.

6. Index Funds

If you think buying individual stocks in the stock market is too risky, Index Funds is your lifesaver.

In a nutshell, Index funds are a diversified, hassle-free, no-fuss and a low-cost means of investing in the Stock market.

When you invest in INDEX FUNDS, you are automatically invested in the Philippines’ TOP 30 Companies whose shares are traded in the Philippine Stock Exchange (PSE).

An Index Fund’s main goal is to “mirror” the PSE index (PSEi).

The PSEI is a stock market index of the Philippine Stock Exchange which consists of 30 companies.

In case you’re wondering what these 30 companies are, here’s the complete list of the PSEI as of Jan 1, 2020:

| 1 | AYALA CORPORATION |

| 2 | ABOITIZ EQUITY VENTURES, INC. |

| 3 | ALLIANCE GLOBAL GROUP, INC. |

| 4 | AYALA LAND, INC. |

| 5 | ABOITIZ POWER CORP. |

| 6 | BDO UNIBANK, INC. |

| 7 | BLOOMBERRY RESORTS CORPORATION |

| 8 | BANK OF THE PHILIPPINE ISLANDS |

| 9 | DMCI HOLDINGS, INC. |

| 10 | FIRST GEN CORPORATION |

| 11 | GLOBE TELECOM, INC. |

| 12 | GT CAPITAL HOLDINGS, INC. |

| 13 | INTERNATIONAL CONTAINER TERMINAL SERVICES, INC. |

| 14 | JOLLIBEE FOODS CORPORATION |

| 15 | JG SUMMIT HOLDINGS, INC. |

| 16 | LT GROUP, INC. |

| 17 | METROPOLITAN BANK & TRUST COMPANY |

| 18 | MEGAWORLD CORPORATION |

| 19 | MANILA ELECTRIC COMPANY |

| 20 | METRO PACIFIC INVESTMENTS CORPORATION |

| 21 | PUREGOLD PRICE CLUB, INC. |

| 22 | ROBINSONS LAND CORPORATION |

| 23 | ROBINSONS RETAIL HOLDINGS, INC. |

| 24 | Semirara Mining and Power Corporation |

| 25 | SECURITY BANK CORPORATION |

| 26 | SM INVESTMENTS CORPORATION |

| 27 | SAN MIGUEL CORPORATION |

| 28 | SM PRIME HOLDINGS, INC. |

| 29 | PLDT Inc. |

| 30 | UNIVERSAL ROBINA CORPORATION |

To know more about Index Funds, CLICK HERE.

7. Pag-ibig MP2

Here’s a definition straight from Pag-IBIG:

The MP2 Savings Program is a voluntary savings program for members who wish to save more and earn higher dividends than the regular Pag-IBIG Savings Program.

In other words, it’s an easy investment for 5 years which we can consider as a low-risk investment but with better earning potential. After 5 years, it’s up to you to invest it for another five years or withdraw.

6 Reasons that make Pag IBIG MP2 a good investment:

1. Affordability & Flexibility

The minimum investment is P500 per month. There is also no maximum amount. You can invest in MP2 as much as you want.

Moreover, you can pay monthly, quarterly and annually.

You may skip the next contribution. Supposing you consistently contributed P1,000 per month from January to July, but in August you went a little tight on your budget.

You can forego your contribution for August and resume on another month. Let’s say you received your bonus. You can resume in December and contribute P50,000 to make up for the previous months’ lapses.

You can also pay once for the entire year. It’s all up to you.

2. Your Pag-IBIG MP2 is backed up by the government

This makes MP2 suitable for a conservative investor because of its low risk meaning the chances of you losing your money are very slim to none. Probably the worst-case scenario is that you would get back what you only have invested which is very unlikely.

3. Earnings are tax-free

The dividends that you earn are exempt from tax. Tax-free means a bigger “take home” of earnings for you. This is an advantage of investing in Pag IBIG MP2 compared to term deposits that have a 20% withholding tax.

4. No limit to no. of Pag-Ibig MP2 accounts

Furthermore, you can open an unlimited number of Pag-IBIG MP2 accounts, with their separate account numbers for identification.

5.High Dividend rates

As mentioned above, MP2 rates have significantly higher rates than savings accounts and time deposits which makes it a better option if you are looking for an investment vehicle with higher returns and minimum capital loss.

6. No fees and charges

That’s one advantage hence your invested amount remains intact.

This are the reasons why this is one of the best investments for beginners! To know more about Pag Ibig MP2, CLICK HERE.

8. Personal Equity and Retirement Account (PERA)

A Personal Equity and Retirement Account (PERA), is a long-term voluntary retirement account that encourages individuals to save and plan for their retirement while enjoying the tax incentives both from:

- the amount contributed to the PERA and;

- the income from PERA investments.

What got me excited with PERA is that it has tax incentives because come on! There are not a lot of investment and retirement options out there that offer tax incentives the way PERA does.

But these tax benefits are just the icing on the cake! PERA has a lot more benefits that make it stand out.

Benefits of PERA account

So, what are the advantages of PERA account that makes it stand out from the other retirement plans?

1. Tax Benefits

- 5% credit on your income taxes which can be used to pay for any income tax liabilities—Each year, you’ll get a 5% tax credit of your total PERA contributions. You can use this tax credit to pay your income tax liabilities. Let’s say your income tax is P150,000, and your total PERA contribution amounts to 100,000. Because you’re entitled to a 5% tax credit of P5,000, you’ll pay only P145,000 in income tax for the year.

- tax exemption on 20% withholding tax on bank deposits, trust funds and deposit substitutes

- tax exemption on 10% withholding tax on dividends

- exempted on capital gains tax on any stocks.

- exempted on regular income tax on PERA products

- tax-free withdrawals

2. Control over where to invest your retirement funds

The investment products to which PERA contributions may be invested in are:

- Unit investment trust funds (UITFs)

- Mutual funds

- Government securities

- Annuity contracts

- Exchange-traded bonds

- Insurance pension products

- Pre-need pension plans

- Shares of stocks listed and traded in the Philippine Stock Exchange

- Other investment products authorized for PERA purposes

3. You can open multiple accounts

4. Employer contribution is allowed

5. Safe from estate tax and insolvency- So in case you die (knock on wood), the money will be released to your heirs WITHOUT having to pay estate taxes.

To know more about PERA, CLICK HERE.

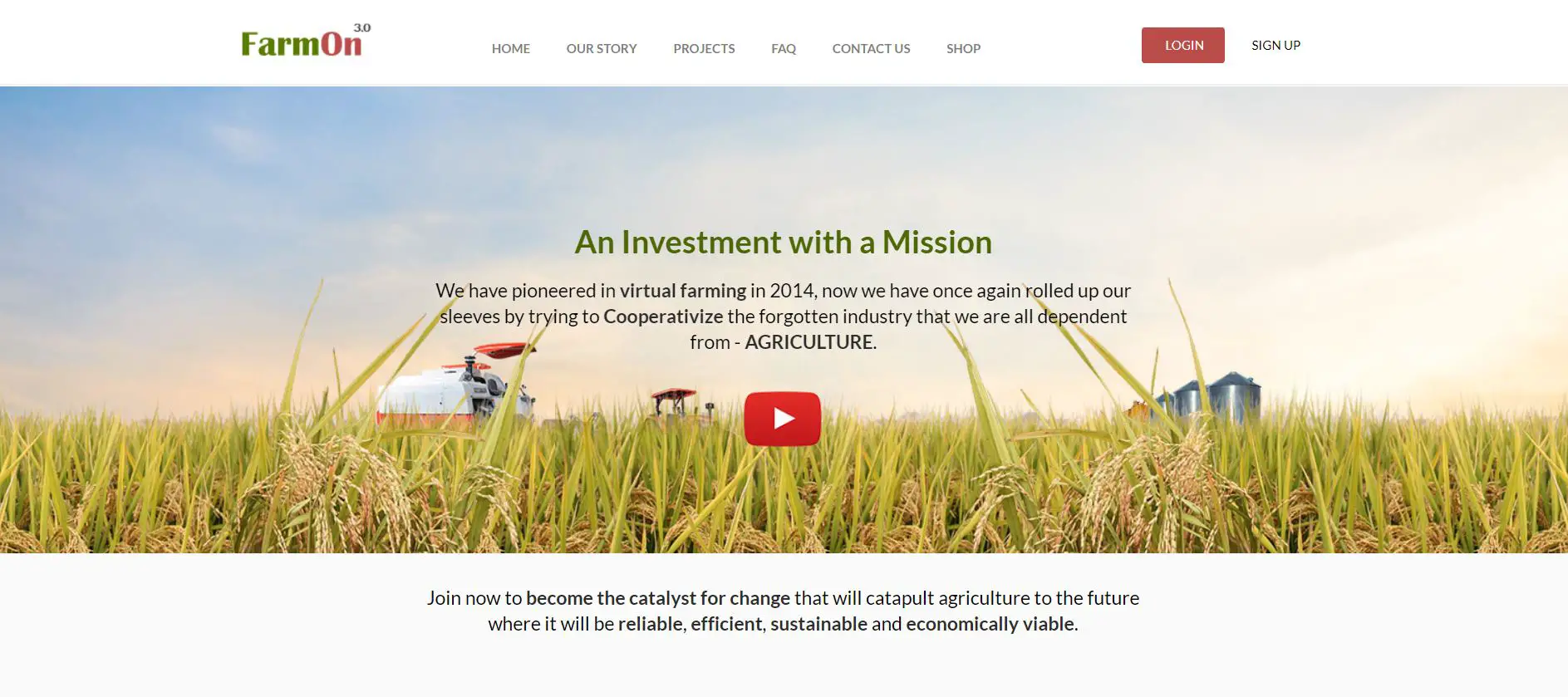

9. FarmOn

“FarmOn.phis a crowdfunding community where people can help farmers on their financial needs and at the same time reap rewards for their contributions. FarmOn.ph was developed by Sproads, a web publishing company based in Manila.”

FarmOn, as a crowdfunding platform, opens a new cycle once there are new farms available for funding.

This is one of the best investments for beginners because your investment will be pooled together with the others.

You fund farmers on their financial needs and at the same time reap rewards for your contributions.

After the harvest and selling of produced goods, you’ll get your share of profits.

In a nutshell, it follows 3 steps:

- Each cycle opens a new project to be funded by crowdfunder.

- The crowdfunders choose specific product from the list

- If the project is successful, members will receive their reward when it is harvest time

To know more about FarmOn, CLICK HERE.

10. Invest in Yourself

Warren Buffett, the famous investor, once said:

The best investment you can ever make is in yourself. Investing in yourself is the best investment you can ever make, BUT investing in yourself is one of the major things in life that gets neglected the most.

Similar to your college degree/masters or any other form of education, investing in yourself is something that you cannot lose-it will always be with you forever.

Sometimes, you might find yourself thinking that investing in yourself might look useless and feel like a waste of time. This probably stems from knowing that your time spent investing in yourself is also the lenient time you don’t make money.

But remember this:

Whatever room for improvements you do for yourself-whether learning a new skill or learning how to grow your money from finance bloggers, THERE WILL ALWAYS BE BENEFITS IN THE FUTURE.

4 Things you must do Before Investing

1. Create an Emergency Fund

Having an emergency fund lets you start your investment journey with a bit more ease.

According to experts, EFs should be at least 6 times worth of your monthly expenses.

This is vital, in case the value of your investments falls, you still have a backup fund to cover your emergencies.

2. Figure out what your Life Goals are

One of the key principles of investing is to NEVER INVEST without a PURPOSE.

What’s your goal? Why are you doing this? Figure that out before you invest a single peso.

Without a specific purpose in mind, you can’t really assess your timeframe for investing and how much risk you’re willing to take on, both of which are vital questions when it comes to investing.

3. Make SMART Goals

SMART Goals should be Specific, Measurable, Attainable, Relevant and Time-bound. By making sure your financial goals have all these characteristics, you can make them more achievable.

The goal, “ I want to save more money starting today,” is ambiguous and meaningless because you haven’t planned out a specific way to accomplish your goal, nor have you created a benchmark to use so you will know if you are attaining your goal or not.

Here’s a proper way to set that kind of goal:

Specific – Be Specific with your goals

“ I will save up P200,000 in my savings account.”

Measurable – Set a benchmark so you know how far you’ve come along in achieving your goal. If you reach P50,000 it means you’re 25% done with your goal of reaching P200,000. If you see P100,000 in your balance, you already know you’re halfway through.

Attainable – If you plan to save P200,000 within 6 months and you very well know from the start that the amount you can only save per month is more or less P10,000, then that goal might be a little too grand for now. Be realistic and make it attainable.

Why not make it your goal to save at the very least P60,000 within 6 months? It is more manageable and less overwhelming.

Relevant – Do your goals inspire you? Why do you want to save P200,000? Is your goal demonstrable too? If you have this goal for no particular reason or you just thought of it out of the blue, then you are bound for failure. Reconstruct it and make it relevant. Declare that you want to save it for your emergency fund or perhaps use it for your child’s tuition fee. And to achieve this you will have to save P5,000 from your salary every payday. You will take the bus to work instead of a taxi and pack your lunch instead of having lunch out every day. Subsequently, your goals must excite you and must have a valuable reason to keep you going.

Time-bound – I will save P200,000 before Christmas (Dec 25) this year. Making your goals time-bound is having a target date. It keeps you committed and gives you a push or motivation to make progress every day as you near your target date.

4. Due Diligence on Investment Options

If you want to know how to invest money wisely, then it is best if you do your due diligence on all the financial products in the market.

Read, read and read. Undoubtedly, there are many financial blogs, financial books, financial groups and forums online that you can learn a thing or two from.

Aside from that, do your research. Broadening your knowledge will give you the confidence in investing no matter how bullish or bearish the market may be.

Even if you plan to have n financial advisor to handle your investing, you should still take the time to understand the things that your money is going to be invested in. Simply trusting someone else to handle it is a no-no.

Conclusion

Those are the top 10 best investments for beginners in the Philippines in 2022!

Now there shouldn’t be any excuse not to have an investment especially in these times.

Furthermore, the best thing about investing is that you have so many options to choose from!

Read these next:

5 Comments