How to avail 70K SSS maternity benefits?

The Social Security System assists its members and their immediate family in all stages of life, starting from birth to buying your own house and even after passing away.

One of the most crucial and happiest moments of your life is giving birth to your child.

If you want to know how to avail yourself of 70k SSS maternity benefits, check out all the details below.

What are the SSS Maternity Benefits?

The Social Security System provides maternity benefits to female members who just gave childbirth, experienced losing an unborn child, or emergency termination of their pregnancy.

It can be filed online through the Social Security System Website, which has been mandatory since September 01, 2021.

There are two types of maternity benefits applications, the MBA and MBRA.

What is the difference between the MBA and MBRA of the SSS?

MBA stands for Maternity Benefit Application, while MBRA means Maternity Benefit Reimbursement Application.

The difference between the two depends on your employment status at the time of childbirth or loss.

If you are currently working for your employer, you should apply for the MBRA.

On the other hand, MBA is for voluntary members, self-employed, non-working spouses, and Overseas Filipino Workers.

Requirements to avail SSS Maternity Benefits

To avail of the SSS Maternity Benefits, the most important thing is that you have paid your monthly contributions for three months within 12 months right before the semester of childbirth or the loss of an unborn child.

It would help if you had a My.SSS Account in the website of the Social Security System as well as an enrolled disbursement account.

The SSS Maternity Notification form must also be filled out and submitted with your ultrasound report and UMID or SSS ID plus two valid identification cards.

Steps to Avail 70K SSS Maternity Benefits

Follow these steps on how to avail of 70k SSS maternity benefits:

Step 1: Make sure to pay your monthly contributions on time at least three months before your childbirth and keep documentation of your pregnancy.

Step 2: Don’t forget to register for a My.SSS account on the Philippine Social Security System website if you do not have one yet, even if you are already an SSS member.

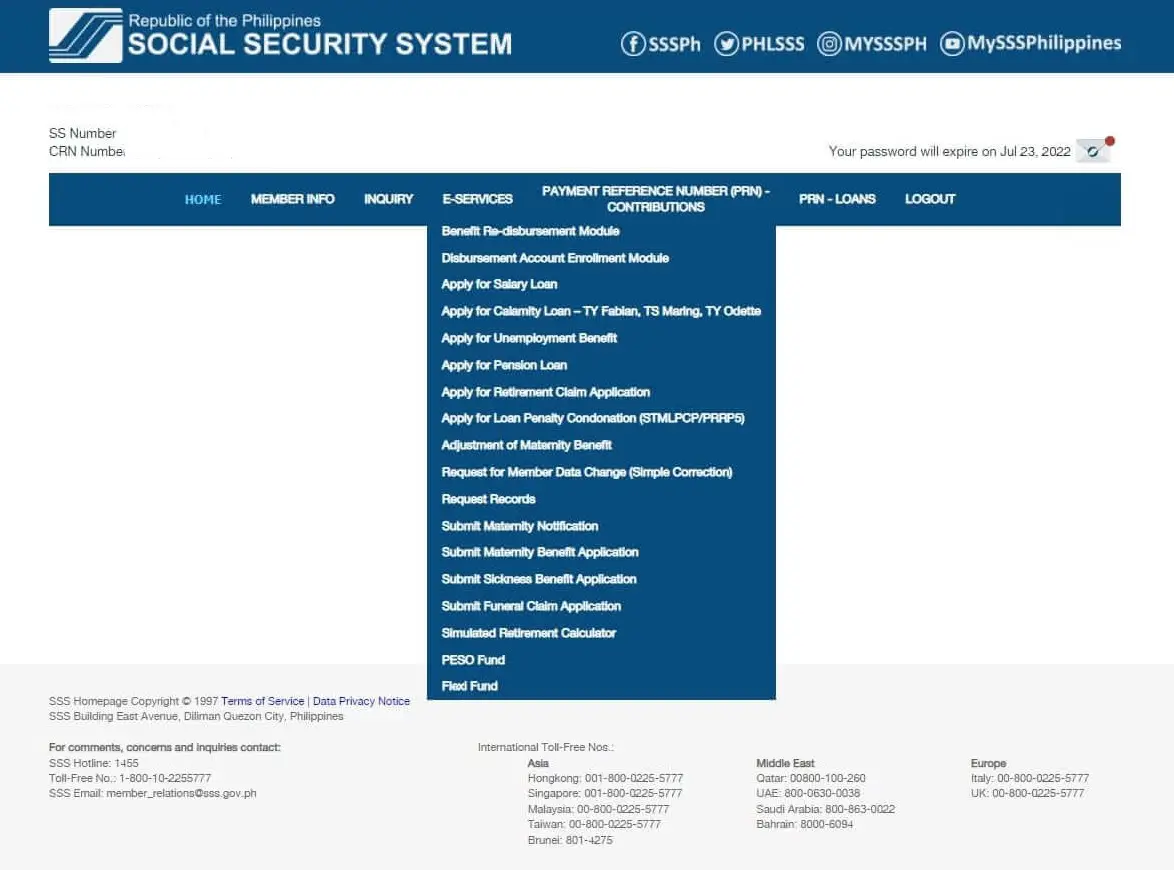

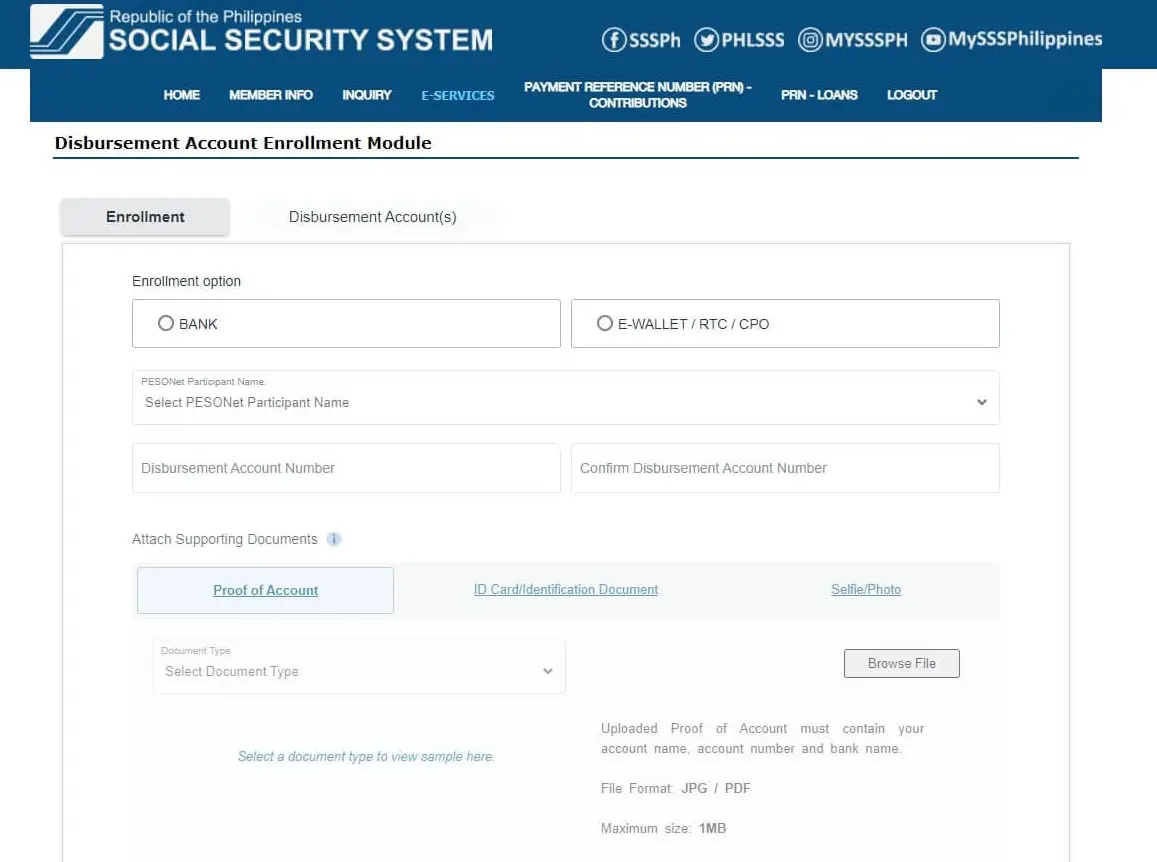

Step 3: Visit the DAEM or the Disbursement Account Enrollment Module under the My.SSS portal and enroll your preferred payout method.

Step 4: If you know that you are pregnant, you must notify your employer of your pregnancy status 60 days from the date of conception of the child.

Step 5: Submit the filled-out SSS Maternity Notification form and proof of pregnancy to your employer if you have one; otherwise, submit it directly via the SSS website.

If you are currently employed, HR will assist you in filing your maternity benefits claim.

How to compute SSS maternity benefit

Logically, your benefits depend on how much your contribution is.

If you work for an employer with basic pay of 20,000 pesos or more and assume that all your contributions are paid, you can get the maximum benefits amount.

For those who are self-employed, there are a few more things to remember:

You must note that there are four quarters in a year, with January to March being the first quarter and October to December being the 4th quarter.

Then, the semester of contingency falls on two adjacent quarters wherein you are most likely to give birth.

You must already be paying your monthly dues for the six months before that semester of contingency.

Let’s say you are planning to give birth in March 2023, which is the Year of the Rabbit, the semester of contingency consists of the first and second quarters of 2023.

Assuming you will have a standard delivery, you should notify SSS or your employer that you are pregnant around August or September 2022 and file the necessary documents.

Your monthly payments will be considered from January 2022 to December 2023.

The latest that you can pay in case you are self-employed is by October 2022 to still qualify.

Now for the computation, the least amount of monthly contribution you need to pay is 2,600 pesos per month to have the monthly salary credit of 20,000 pesos.

If you have paid this amount for six months, you will multiply 20,000 by 6, then divide the product by 180 days, which will be your ADSC amounting to about 666. 67 pesos.

You will then multiply the ADSC by 105 days for normal and cesarean delivery, 120 days if you are a solo parent, or just 60 days for the loss of an unborn child.

Thus, you get 70,000 with an additional 10,000 for solo parents.

If you just started paying by October 2022, the top 6 highest monthly salary credits will be 60,000 pesos, corresponding to the ADSC of 333.33 pesos, so you get only half.

Increasing your contribution will not increase your monthly salary credit, so it’s better to start paying in July 2022.

FAQs

What is the Average Daily Salary Credit?

The ADSC or Average Daily Salary Credit depends on the amount of your SSS contribution.

SSS provides the table, with the lowest value being 3,000 pesos for low-income earners up to a maximum of 20,000 pesos monthly salary credit.

The sum of your top 6 monthly salary credit gets divided by 180 days, and that is your ADSC.

What is a quarter in SSS computation?

It is the four groups of non-overlapping three consecutive months starting from January, April, July, and October.

What is a semester in SSS computation?

A semester is composed of 2 adjacent quarters, such as the 4th quarter of 2022 and the 1st quarter of 2023.

If I missed one month of payment? Can I still claim my maternity benefit?

Yes, you can still claim your maternity benefit, but if you miss some payments during the past year before your semester of childbirth, there will be deductions unless you have paid for at least six months.

For example, you missed a payment six months ago when you changed employers and did not bother to pay it; you can still claim the maternity benefit if you have paid for the two quarters before your semester of contingency.

What is a disbursement account for SSS claims?

It is the payment point where you can receive your benefit from SSS, and it can be a bank account, e-wallet app, Cash Payout Outlets, or Remittance Payout Companies.

Can I claim SSS maternity benefit even if I am a single mom?

Yes, your civil status does not affect your ability to claim the maternity benefit whether you are a solo parent or not yet married.

Conclusion

The Social Security System of the Philippines supports its female members in one of the most critical days in their life.

If you are a soon-to-be mom, don’t forget to prepare the documents needed to claim your SSS Maternity Benefits and pay your dues on time.

Read these next:

2 Comments