The SSS or Social Security System of the Philippines offers different loans to its members.

You can avail of a loan if you are a member in good standing with SSS, much more if you have more enormous contributions.

If you want to know how to apply for SSS loans online, check out all the loans detailed below.

How to apply for an SSS salary loan online

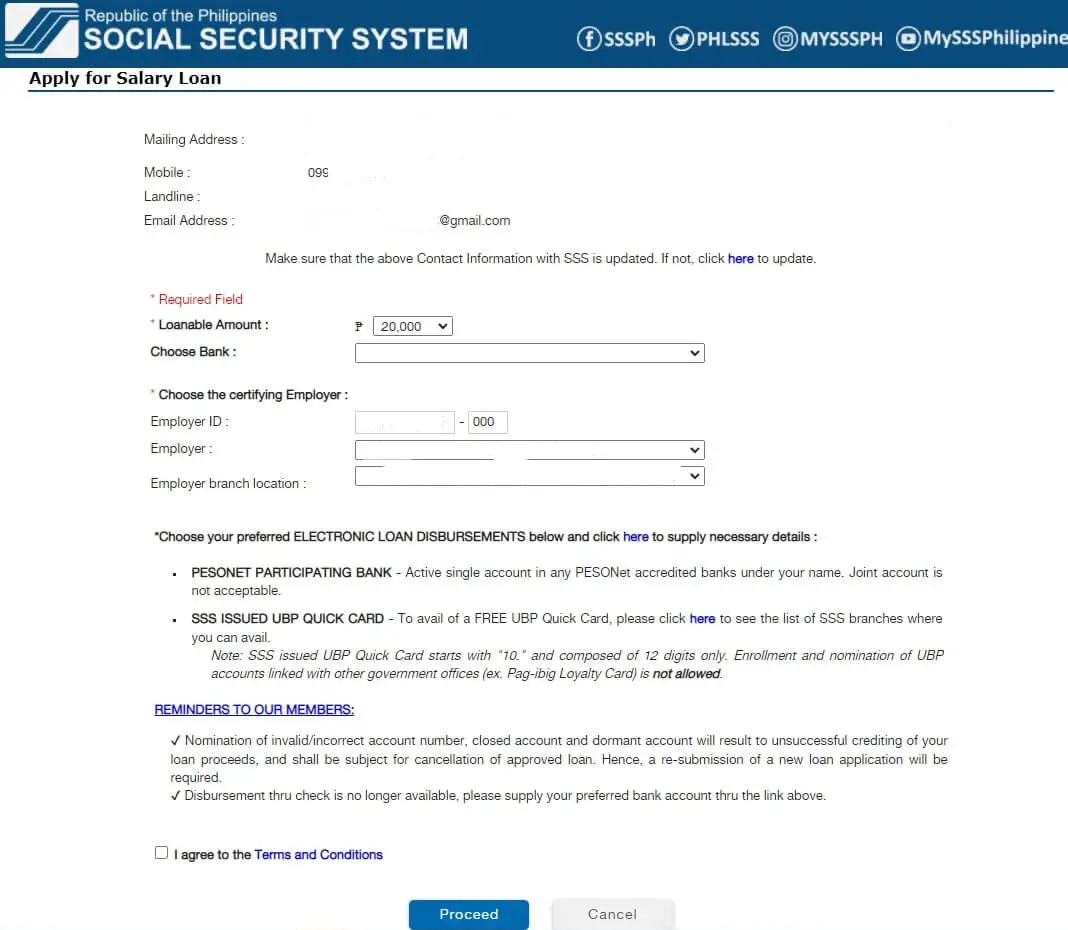

Follow these steps on how to apply for an SSS salary loan via the SSS website:

Step 1: Go to https://member.sss.gov.ph/ and log in to your account.

Step 2: Click Apply for Salary Loan under the E-SERVICES tab.

Step 3: If it is your first time applying for an SSS loan, check the box signifying you have understood the reminders on account enrollment for DAEM.

Step 4: Choose between a bank or e-wallet account and enter the account number.

Step 5: Select your preferred supporting documents and upload the required files.

Step 6: Signify agreement to the terms of service by checking the box.

Step 7: Click the Enroll Disbursement Account button.

Step 8: Wait for the notification of the successful application and take note of your transaction number.

You can also check for the transaction number in the notification sent to your email.

If you did not receive a notification, your application did not proceed, possibly due to a slow internet connection.

What are the requirements in applying for SSS salary loan?

To apply for an SSS salary loan, you must have at least 36 months’ worth of contributions, with six paid within the last 12 months.

If you want a 2-month salary loan, you must have double the number of contributions, with at least six contributions within the past 12 months.

If you are an employee, you need an E-6 or SSS digitized ID, two valid IDs with your picture, and a My.SSS account.

Overseas Filipino Workers or OFWs or their representatives can apply through the SSS Foreign Representative Offices abroad or in the Philippines.

The OFW only needs their SSS or UMID card and two valid IDs with photos and signatures.

On the other hand, if they apply through a representative in the Philippines, there should be a letter of authority signed by OFW and their representative.

The identification requirement for representatives can also be an SSS or UMID card or two valid IDs with photos and signatures.

How many days before I can get my SSS salary loan online?

If you have applied for an SSS salary loan as an employee, your employer may need up to three working days to certify your application.

Funds may be released to your enrolled account from 3 to 15 working days after the approval of your application, depending on your disbursement account.

The approval itself from SSS should only take one working day, and you should repeat your application just in case you did not receive a notification.

You may be able to get your salary loan in 4 to 19 working days.

How much is the first loan in SSS?

The amount you can loan from SSS is not fixed, but it is the average of your monthly salary credit for the past 12 months.

This means that you can get a maximum loan amount of P20,000 since it is the highest monthly salary credit for SSS.

If you have some months with no contributions for the past year, that will lower the amount that you can get.

How can I check my loanable amount in SSS?

You can see the amount you can borrow when applying for a loan through the My.SSS website.

Beforehand, you can also get an idea of how much this is if you know your contributions for the past 12 months.

If you have an existing loan, you just need to deduct your outstanding balance from the loanable amount.

How to apply for an SSS pension loan online

SSS launched the PLP or Pension Loan Program as a better means of extending credit to pensioners at a more affordable rate compared to loan sharks.

Take note that online application is only allowed for those who have already applied for a loan pension before.

These are the instructions on how to apply for an SSS pension loan via the SSS website:

Step 1: Go to https://member.sss.gov.ph/ and log in to your account.

Step 2: Click Pension Loan Application under the E-SERVICES tab.

Step 3: If you have not previously applied for an SSS loan, check the box signifying that you have understood the reminders on account enrollment for DAEM.

Step 4: Enter the account number after choosing between a bank or e-wallet account.

Step 5: Upload the required files after selecting your preferred supporting documents.

Step 6: Checking the box of the Terms of Service window.

Step 7: Tap the Enroll Disbursement Account button.

Step 8: Wait for the successful application notification and take note of your transaction number.

You can also check your email for the notification of the transaction number.

If you are a first-time applicant for a pension loan, you need to apply in person by visiting your SSS branch based on the number coding scheme.

What are the requirements for pension loan applications?

A pensioner can apply for a loan as long as they can select a payment term that will end before they turn 86 years old.

More specifically, it should not be their 86th birthday in the month of the last amortization.

They must also clear any outstanding loan balance and benefit overpayment from SSS.

There should be no advance pension currently from the SSS Calamity Assistance Package.

Most importantly, they should have an Active pension status and have received at least one month of pension from SSS.

How much pension loan can I get from SSS?

The actual amount depends on your BMP or basic monthly pension.

You can avail 3, 6, 9, or 12 times the amount of the BMP, with an added P1000 benefit.

It can be any amount as long as it does not exceed P200,000.

The take-home amount must not be lower than 47.25% as well.

How much is the interest of a pension loan?

Like the salary loan, a pension loan has an interest of 10 percent per annum for the outstanding loan balance.

The good thing is that the one percent service fee is already waived.

How to apply for an educational loan in SSS online

You cannot apply for the EALP or the SSS Educational Assistance Loan Program online.

Inquiries may be made online, and you are lucky if your SSS branch will allow online submission of requirements.

However, the release of the check can only be done in person, and you may claim it at your SSS branch.

What are the requirements for availing of an educational loan?

The essential requirement is a filled-out SSS EALP application form and valid IDs.

You can download the form at https://www.sss.gov.ph/sss/DownloadContent?fileName=mlp-01338.pdf.

The borrower must also be able to present a billing statement from the school of their beneficiary.

In addition, proof of relationships such as birth or baptismal certificates and marriage certificates must be attached.

The most recent ITR or BIR Form 2316 is also needed, or a notarized affidavit of no income.

If someone else will be paying for the amortization, an affidavit of the source must be accomplished, indicating the amount of monthly income.

How much educational loan can I get from SSS?

If the beneficiary has a 4-year degree program, the maximum allocation will be P160,000.

For a 5-year degree program, that goes up to P200,000, given that there are ten semesters, 15 trimesters, or 20 quarters.

There is a maximum allocation of P10,000 per semester or trimester for a two-year vocational course, which means you can get either P40,000 or P60,000 maximum.

How much is the interest of an educational loan?

An educational loan from SSS has a six percent lower interest rate per annum.

Don’t forget that there is a two percent maintenance charge and a one percent penalty fee for late payments.

How to apply for the SSS loan restructuring program online

The SSS loan restructuring program is not regular and is only periodically offered by SSS.

The last one is from April 28, 2016 to April 27, 2017 due to various calamities from 2009 to 2015.

Don’t get your hopes up if you have overdue loans, as you are more likely to pay for it, including the penalties.

You can understand the eligibility requirements and other terms and conditions by reading the previous Loan Restructuring Application form.

You can download the form here.

How to apply for SSS loan condonation online

The SSS launched the loan condonation program to help its members who suffered from the pandemic.

SSS only made this available from November 15, 2021, to February 14, 2022.

As a result, they only need to pay the principal and interest to save on penalties.

Follow these steps on how to apply for SSS loan condonation:

Step 1: Go to https://member.sss.gov.ph/ and log in to your account.

Step 2: Click Apply for Loan Penalty Condonation under the E-SERVICES tab.

Step 3: Choose between installment or one-time payment under the Preferred Term dropdown menu.

Step 4: Check the details and read the Terms & Conditions, Promissory Note, Disclosure Statement, and Certification and Undertaking before clicking the Agree button.

Step 5: Click the Submit button.

Step 6: Make sure to keep a copy and thoroughly read your approval notice, then click the Confirm button.

Step 7: Take note of the PRN generated by the SSS.

You may pay the total amount or the downpayment and subsequent installments depending on your preferred term.

What are the requirements for availing of SSS loan condonation?

You need to have an existing loan of any of the following:

- Calamity Loan

- Salary Loan

- Salary Loan Early Renewal Program or SLERP Loan,

- Emergency Loans and Restructured Loan from the 2016-2019 Loan Restructuring Program (LRP)

Also, you need to have an overdue loan six months before the loan condonation program starts.

Here are the other requirements:

- must not have received a final benefit from SSS

- the contingency date of a final benefits application should only be until the last day of the condonation program’s period of availment, including death benefit application by heirs

- must not have been disqualified due to fraud

- must be 64 years old or younger at the last month of the installment term of the consolidated loan, if they decide to pay via installment

How do I know if my SSS loan is available?

You can check whether your SSS loan is already available or approved by checking your My.SSS account.

Go to the Inquiry tab, then Loans Info, to check all details about your loan.

What banks are accepted by SSS?

The following banks are included in the list of banks for the DAEM of SSS, excluding e-wallets and cash pick-up option:

- Al-Amanah Islamic Bank

- Allbank (A Thrift Bank), Inc.

- Asia United Bank

- Australia and New Zealand Bank

- Banco De Oro Unibank, Inc.

- Bangkok Bank Public Co

- Bank of America

- Bank of Commerce

- Bank of Florida, Inc (A Rural Bank)

- Bank of The Philippine Islands

- BDO Network Bank, Inc (A Rural Bank)

- China Bank Savings

- China Banking Corporation

- CIMB Bank Philippines

- Citibank, N.A.

- CTBC Banking Corporation

- Deutsche Bank

- Development Bank of the Philippines

- Dungganon Bank Inc.

- East-West Banking Corporation

- Equicom Savings Bank

- First Consolidated Bank

- Industrial Bank of Korea-Manila

- ING Bank, N.V.

- JP Morgan

- Keb Hana Bank

- Land Bank of the Philippines

- Malayan Bank Savings and Mortgage Bank

- Maybank Philippines, Inc

- Mega Intl Commercial Bank Co. Ltd

- Metropolitan Bank and Trust Company

- Mizuho Bank

- MUFG Bank, Ltd.

- Philippine Bank of Communications

- Philippine Business Bank

- Philippine National Bank

- Philippine Savings Bank

- Philippine Trust Company

- Philippine Veterans Bank

- Producers Savings Bank

- Rizal Commercial Banking Corp

- Robinsons Bank

- Security Bank Corporation

- Shinhan Bank

- Standard Chartered Bank

- Sterling Bank of Asia

- Sumitomo Mitsui Banking Corp

- The Hongkong and Shanghai Banking Corp

- Union Bank Quick Card

- Union Bank of The Philippines

- United Coconut Planters Bank

- United Overseas Bank (Phils)

- Wealth Development Bank

- Yuanta Savings Bank

Can a voluntary SSS member apply for a loan?

Yes, you can apply for an SSS loan even if you are a voluntary member.

This means that you can apply directly to SSS, and you will be the only one responsible for repaying the loan.

In the least, you don’t have to worry about an employer not remitting your monthly payments.

How to pay for an SSS loan as a self-employed or voluntary member

Here are the steps on how to pay for your SSS loan if you are paying it by yourself:

Step 1: Get a PRN or Payment Reference Number via SSS branch, email, SMS, or the SSS member portal.

Step 2: Pay it via walk-in or online payment options.

Step 3: Wait for the email or SMS notification to ensure that your payment was posted.

The key here is always to generate a payment reference number first because this allows for the SSS’ RTPL or Real-Time Processing of Loans program.

How to pay for an SSS loan as an employer

If you are an employer, follow these steps on how to pay the loans of your employees:

Step 1: Log in to My.SSS employer account.

Step 2: Click the RTPL tab.

Step 3: Print the PRN of the applicable loan collection list after checking it for accuracy or editing using the following menu:

- EDIT LCL – if the information to be updated is only the amount to be paid

- ADD RECORD – if you want to add an employee who is not yet on the list

- CREATE NEW LCL – if you need to select some employees and make a new LCL for them

- DOWNLOAD LCL – if you want to download the LCL and edit it offline using Microsoft Excel

- UPLOAD LCL – will be used once you are done editing the offline LCL file

Step 4: Make a payment using the PRN at walk-in or online payment options.

Step 5: Check SMS and email for notification that the payment was posted.

The only added step for employers is to generate or edit an LCL that generates a PRN for a collective group of employees, rather than paying for each one individually.

FAQs

What are the walk-in options for paying SSS loans?

Whether you are an employer or a voluntary member, you can pay for the monthly amortization of loans through walk-in at Bayad Center, CashPinas, Partner Rural Bank, RCBC, Rural Bank of Lanuza Inc., SM Mart Inc., Security Bank, Union Bank of the Philippines, or an SSS branch with ATS or Automated Tellering System.

If you are an OFW, you can pay at an overseas branch of the Philippine National Bank.

What are the online payment options for paying SSS loans?

There are also more convenient and time-saving options to pay for SSS loans, such as GCash, Moneygment, Security Bank, and Union Bank of the Philippines, for employers and voluntary members.

For OFWs, Ventaja International Corporation and i-Remit, Inc. are options.

Employers can also pay via the BancNet eGov facility of the following online:

- Asia United Bank

- Bank of Commerce

- China Bank Corporation

- CTBC Bank

- EastWest Bank

- Metropolitan Bank and Trust Company

- MUFG Bank

- PBCOM

- PNB

- Philippine Trust Company

- Philippine Veterans Bank

- RCBC

- Robinsons Bank

- Standard Chartered Bank

- UCPB

Can I still apply for SSS salary loan after receiving the final benefits?

If you have already received your retirement or total permanent disability benefits, you can no longer apply for an SSS loan.

Your family members cannot apply for a salary loan on your behalf in case of your death since your beneficiaries will already have the death benefits.

Can I apply for a salary loan if my employer has a problem?

No, you will not be able to apply for a salary loan if your employer fails to remit loan payments and monthly contributions to SSS regularly.

In case your employer has a problem with you, if you are not able to pay for your outstanding loans, you cannot apply for an SSS salary loan.

What is the proof of account ownership for the DAEM or Disbursement Account Enrollment Module?

Depending on your selected payout method, the requirements can change.

If you have a bank account, you may present a 2020 or later bank certificate or statement, an ATM card with your name and account number, a passbook, a deposit slip, a foreign remittance receipt, or a screenshot of your mobile banking account.

If you have an e-wallet account like GCash, you need to provide a screenshot of your account.

What e-Wallets are accepted in SSS DAEM?

If you have a GCash, PayMaya, and Coins.ph account, you can add them to the Disbursement Account Enrollment Module of SSS.

If you do not have an e-wallet account and do not have a bank account or other options to claim your loan, you can do it using the cash pick-up arrangement of DBP Cash Padala through MLhuillier.

What disbursement accounts do not need proof of account ownership?

Suppose you prefer to receive your SSS loan using UMID-ATMs, DBP Cash Padala via M Lhuillier, and existing bank accounts under Sickness and Maternity Benefits Payment Module or SMBPB. In that case, you don’t need to present proof of ownership anymore.

Where can I get a free UBP Quick Card?

You can check the nearest UnionBank branch at https://www.unionbankph.com/contact-us/directory and contact them via landline or mobile phone number to verify if they offer a UBP Quick Card.

Can I still open a UBP Quick Card account even though I have a Unionbank account?

Yes, you can still open a separate Quick Card account from your current or savings account if you want to separate your finances.

All three accounts are eligible for the SSS DAEM.

Where can I contact UnionBank for concerns?

If you have questions about UnionBank, you can reach their 24-hour customer service by calling (+632) 8841-8600 (Metro Manila), 1-800-1888-2277 (PLDT toll-free), or (IAC) + 800-8277-2273.

You can also send an email to customer.service@unionbankph.com.

If you want to inquire in person, their head office is located at UnionBank Plaza Bldg., Meralco Ave. corner Onyx St., Ortigas Center, Pasig City, Philippines.

Up to how many months can I pay my SSS salary loan?

If you have applied for, approved, and received your SSS salary loan, you have 24 months or two years to pay it back, including the interest.

However, you can pay in advance to save on the monthly interest fees.

Your first payment starts two months after your loan gets approved.

When is the monthly due date for payment of the SSS salary loan?

The monthly due date of your SSS loan amortization is not fixed and depends on a scheduling table.

Your due date can fall on either the 10th, 15th, 20th, 25th, or last day of the month.

Your schedule will depend on the 10th digit of the employer or HR’s registration number or your own SS number if you are a self-employed or a voluntary member.

This shows the due date depending on the 10th digit:

- 1 and 2 – 10th day

- 3 and 4 – 15th day

- 5 and 6 – 20th day

- 7 and 8 – 25th day

- 9 and 0 – last day

Don’t forget that the payment due date is always the following month after the applicable month.

For example, if the indicated applicable month is August, the due date is September.

Moreover, you have the option to pay quarterly if you are a self-employed or voluntary SSS member.

You should check the details in your My.SSS account.

What if my SSS salary loan defaults?

If your salary loan defaults, you may pay it with additional interest and penalty, or it will be deducted from your future benefits.

If every SSS member who has a loan suddenly decides not to pay their monthly amortization for the salary loan, SSS will continue to do business as usual.

This is because a member cannot borrow more money than their previous contributions.

There will still be something left for you in the extreme scenario that you cannot pay for a defaulted loan.

It will be automatically deducted from short-term benefits such as Sickness, Maternity, and Partial Disability.

Otherwise, it will be deducted from your death, total disability, or retirement benefits.

Don’t forget that there is a 10 percent interest per annum on the unpaid principal balance and a one percent monthly penalty for both interest and the unpaid balance.

It’s better to pay as early as you can, although you are already paying late, rather than being surprised with benefits deductions in the future.

You can even pay for your remaining loan through another loan from SSS.

Can I renew my loan while I still have an outstanding balance?

Yes, you can apply for a loan renewal if you have already paid half of the principal amount and half of the payment term has elapsed.

In short, you can only apply for loan renewal after one year if you are in good standing.

Opt for this if you can pay more per month towards your loan amortization since you may be able to save a little bit more on interest.

What is the repayment term of SSS loans?

SSS loans can be paid in two years or 24 months, which makes repayment light to the SSS member.

On the other side, this allows SSS to generate income from the interest applied.

You can pay more in advance if you want to pay less on the monthly interest, but practically, this does not speed up the time to get a new SSS loan.

Who should pay my SSS loan?

If you are a self-employed or voluntary member, you can pay for your loan directly to SSS.

An employer will make repayment a little easier for you since they should automatically deduct your monthly amortization from your salary and remit it to SSS.

In case your employment ends due to any reason such as retirement, resignation, termination, or closure of the company, you will be the one to continue making the payments.

What are the responsibilities of an employer on loan repayment?

Being an employer requires that you process transactions on behalf of your employee.

You certify the loan application of an employee, and you are also tasked with deducting monthly amortization from their salary.

If the separation pay or any remaining salary of an employee is not enough to cover all of the outstanding balance, SSS must be informed of the date of separation.

Employees must also submit an updated SSS statement of account to be required by their new employer.

If an employee has an outstanding loan, the new employer will resume the responsibility of deducting the monthly repayment and remitting the same to SSS.

Is there a service fee for SSS loans?

Yes, there is a fixed one percent fee of the approved loan that will automatically be deducted from the amount released to you.

The amount released to your disbursement account is 99 percent of the approved amount, and you should not panic about a mystery deduction.

If you have an outstanding loan, it will also be deducted from the disbursed amount.

What happens if I make an overpayment for an SSS loan?

Overpayment is alright with SSS as it does not require exact payments for them to be valid.

You can request a refund from SSS, but by default, it will be treated as an advanced payment if you have successfully applied for a new loan.

Who pays for the loan in case a pensioner passes away?

When a pensioner passes away while still having an outstanding loan, no one has to pay for it.

Group Credit Life Insurance covers all Pension Loan Borrowers, and they automatically pay for it through a one-time deduction.

The borrowers are covered as long as they have an existing loan and remain unemployed.

SSS does not deny loan applications on grounds such as ill-health because the loan intends to help the pensioners.

Evidence of insurability is not even required from any pension loan borrower.

Who is eligible for the SSS Educational Assistance Loan Program?

SSS members who are 59 years old or younger have monthly incomes lower than P50,000, with at least 36 monthly contributions and six are within the last 12 months, and with up-to-date payments in any other SSS, the loan can apply for the EALP.

There is no guarantee of approval for initial applicants, but you can get a loan if you are already approved before for other SSS loans as long as you have no overdue.

Of course, you need to have a beneficiary that studies accredited by CHEd, TESDA, CAAP, or the Philippine Government.

Even as a scholar, they can only qualify for the fees they need to pay.

The beneficiary can be yourself, your legal spouse, your biological or adopted child, or your sibling as long as you are single.

How to for an Apply SSS Loan Online – Conclusion

SSS makes it mandatory for its members to save money and even lets them borrow the same with interest.

Don’t forget to pay your monthly contributions even if you are a voluntary member, so you can always rely on an SSS loan in times of need.

Read these next: