Whether you want to have your dream home or you need funds for sudden expenses, Pag-IBIG has got your back.

If you are a member, you can contribute and access its mutual fund that has helped many Filipinos since 1978.

If you want to know how to apply for a PAG-IBIG loan online, read more details below.

What is Pag-IBIG?

Pag-IBIG or the “Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industria at Gobyerno” is an entity created by the government to provide affordable housing loans to working members of the public.

There is a mandatory membership with Pag-IBIG if you are a member of either the Social Security System or the Government Service Insurance System.

In short, it is a mandatory savings program if you are either a government employee or an SSS member.

What is the Pag-IBIG Loan?

Being a member of Pag-IBIG means that you contribute to the Pag-IBIG Fund, which allows you to both save and borrow money.

This entitles you to different loan types with just a small interest rate.

Different Loans in Pag-IBIG

There are three types of loans in Pag-IBIG, including Calamity Loan, Housing Loan, and Multi-Purpose Salary Loan.

The Calamity Loan and the Multi-Purpose Loan are short-term loans that can be paid for up to 24 months, with a grace period of 3 and 2 months, respectively.

You can avail of the Housing Loan even if you earn minimum wage, and it is payable for up to 30 years.

The Calamity Loan is applicable for those located in areas where the President of the Sangguniang Bayan has declared a state of calamity.

As the name suggests, the Multi-Purpose Loan is for various expenses, including minor house repairs or improvements.

Requirements to apply for a Loan in Pag-Ibig

For both Multi-Purpose and Calamity Loans that are both short-term loans, you need to prepare a fully-accomplished application form, a scanned copy of 2 valid identification cards, and proof of income.

Just in case you will use your Payroll Account or Disbursement Card to release the loan, you or your employer must also present a photocopy of the deposit slip of the account of concern.

If your employer processed the application, they must provide a certification of the Payroll Account or the Disbursement Card.

If you processed it yourself, you need to have the original Payroll Account or Card for authentication purposes.

The Package Unit ID photocopy must also be submitted if you prefer disbursement through your Citibank Prepaid Card.

There is just additional requirement for Calamity Loans such as Municipal Agricultural Office certification for damaged crops, Mayor’s certification for affected vendors or business owners, or Doctor’s Medical Certificate for those who got sick.

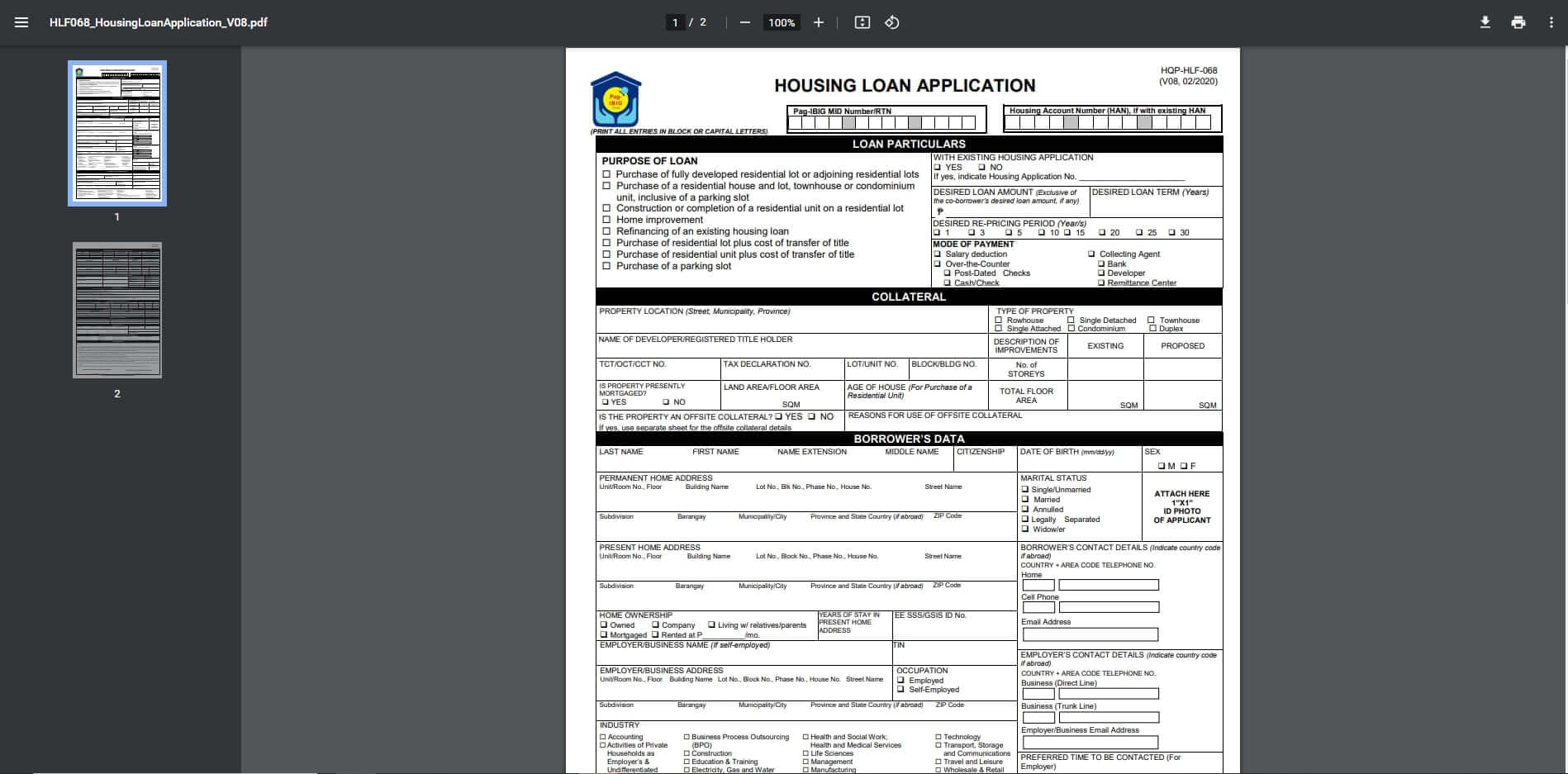

For a Housing Loan, you need the accomplished application form, proof of income, a valid ID of you and your co-borrower and seller, and housing developer’s representative, as well as certified copies of TCT or CCT, tax documents, and sketch map concerning the property from the seller and/or borrower.

How to Apply for Pag-IBIG Loan Online

Follow these steps on how to apply for a Pag-IBIG loan online:

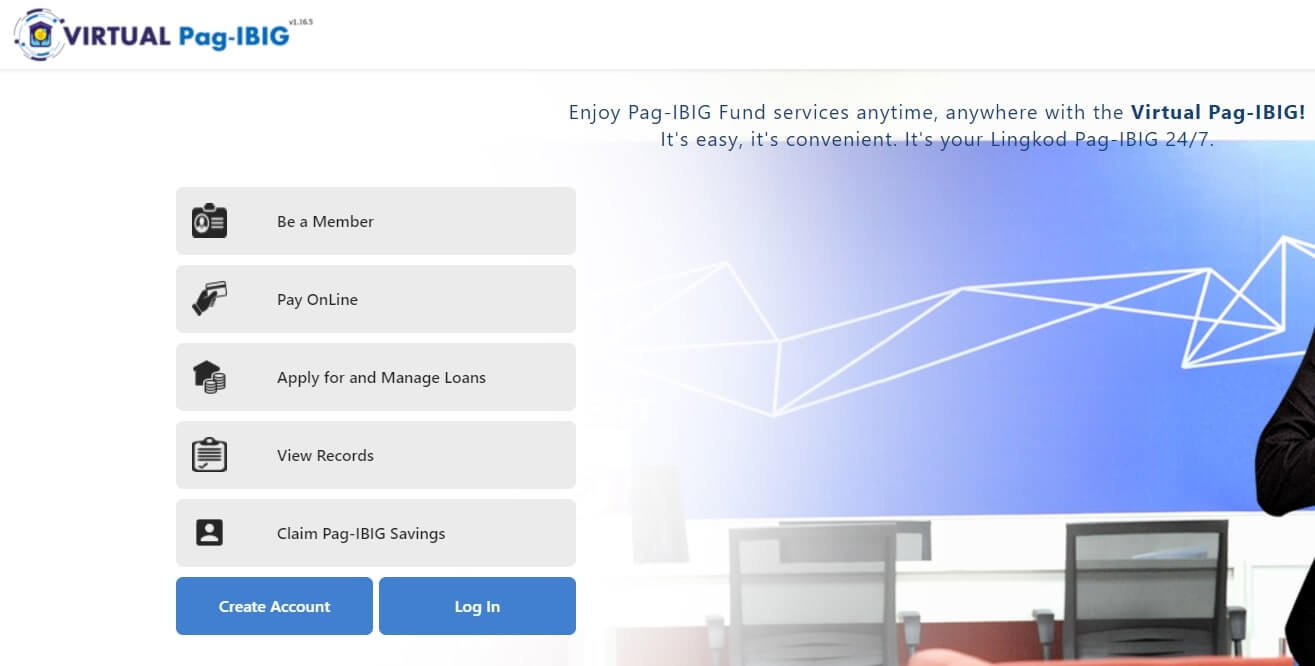

Step 1: Go to https://www.pagibigfundservices.com/virtualpagibig/

Step 2: Select “Apply for and Manage Loans”

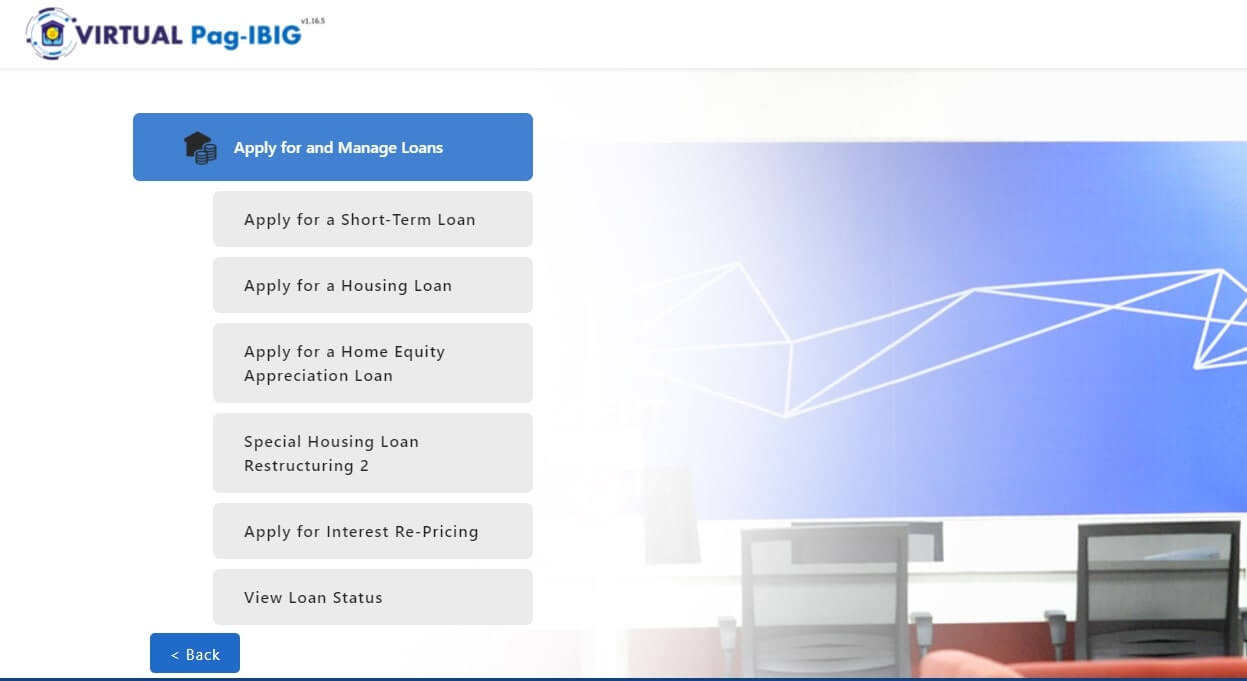

Step 3: Select the type of loan that you want to apply for

Step 4: Fill out the digital form from https://www.pagibigfund.gov.ph/ and save it as a PDF.

Step 5: Submit the documents and requirements to your employer, who will process the application.

Step 6: If you do not have an employer, apply directly via email to your branch or use the contact forms at https://www.pagibigfund.gov.ph/contactus.html.

How to Pay Pag-IBIG Loan Online

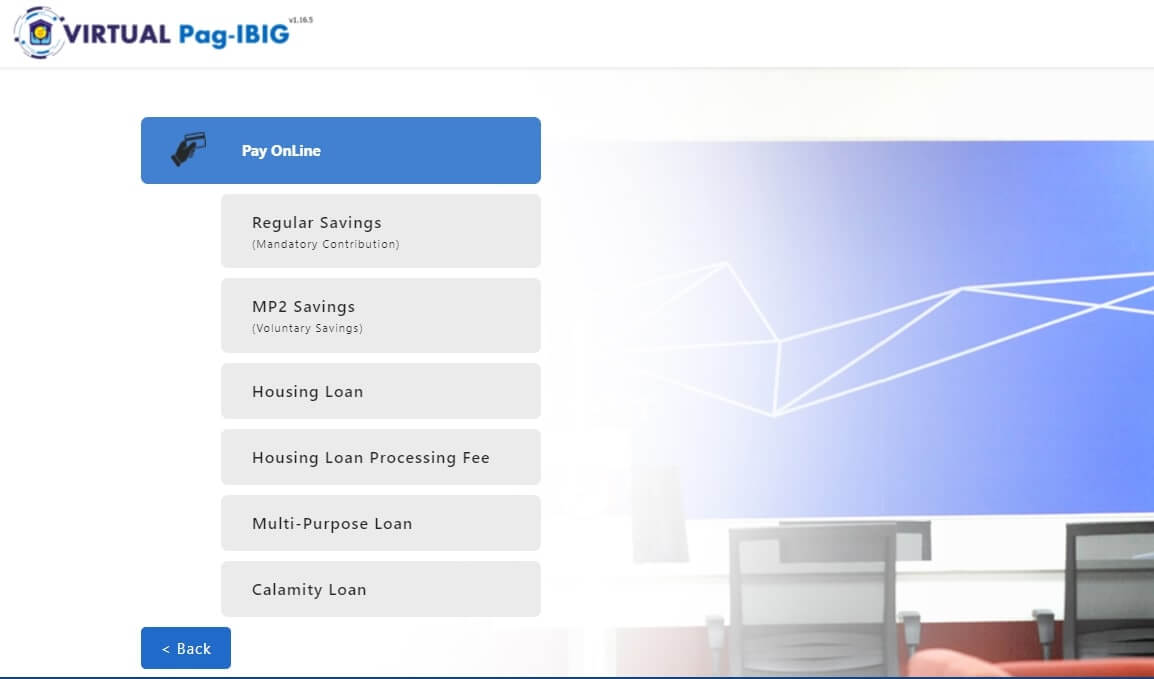

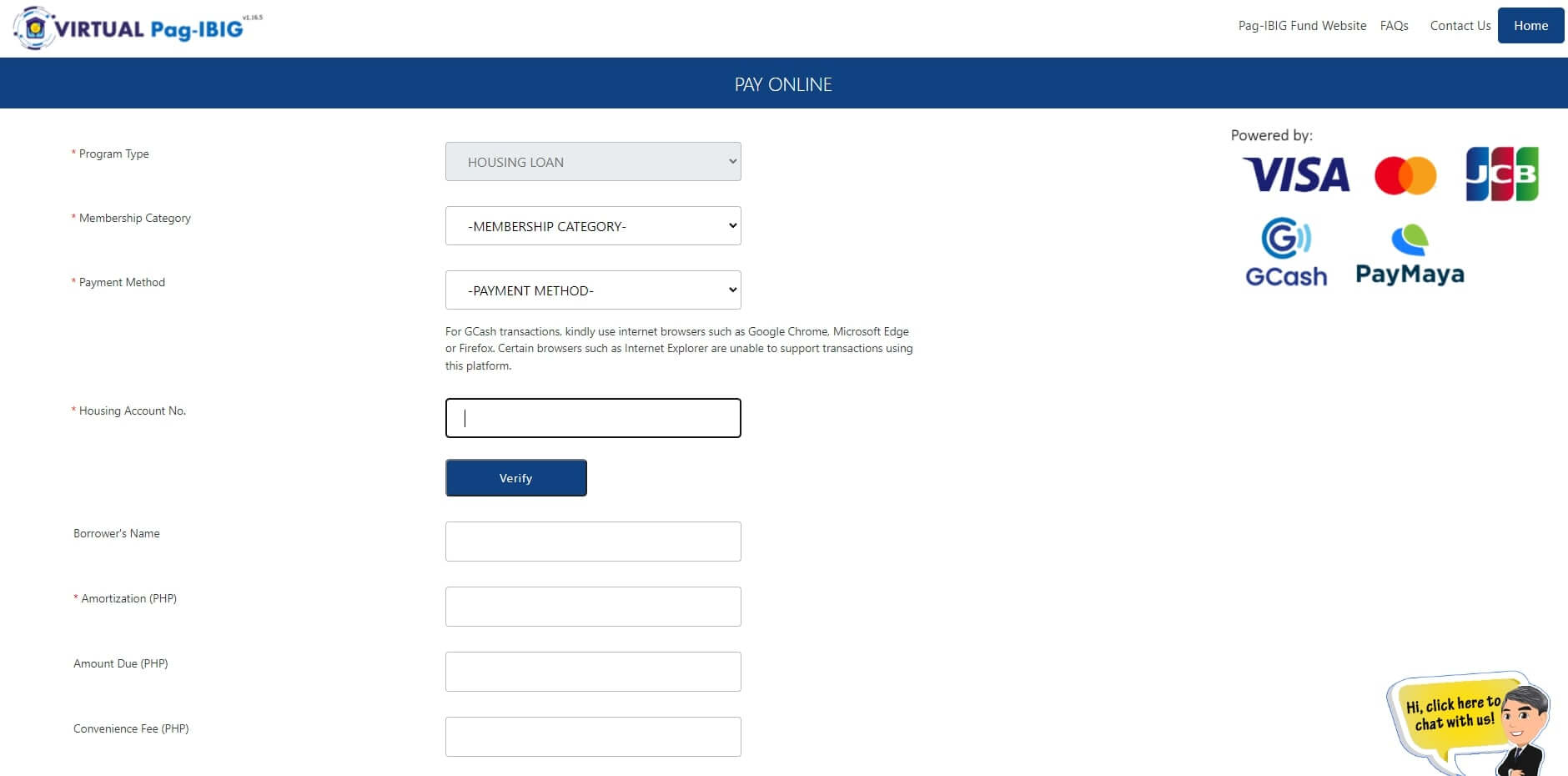

You can pay your loan online using these steps:

Step 1: Go to www.pagibigfund.gov.ph and log in to your account.

Step 2: Go to E-Services, then Online Payment Facilities.

Step 3: Enter all the required details such as Membership Category, ID or Tracking Number, Payment Type, Amount Due, Period Covered, and Contact Details.

Step 4: Solve the captcha, and tick off the Terms and Conditions before tapping Proceed.

Step 5: Enter your debit or credit card details and follow the remaining prompts.

Don’t forget to save a digital and printed copy of your receipt for future reference.

You can also pay your loans through online collecting partners, including CashPinas Moneygment App, ECPay, GCash, and MLhuiller.

How to Pay Pag-IBIG Loan via other Collecting Partners

You can pay your loan directly through a Pag-IBIG branch or its collecting partners in establishments using over-the-counter payment in banks such as UCPB, AUB, MetroBank, and LandBank, as well as other establishments such as Bayad Center, Savemore, SM Business Service Centers, and SM Hypermarket.

FAQs

Who are eligible for Pag-IBIG Multi-Purpose Loans?

To be eligible to avail of the MPL, you need to have paid contributions for 24 months in the least, one of which is made in the past six months, must not have an existing Pag-IBIG loan in default, and must have proof of income.

Who are eligible for Pag-IBIG Calamity Loans?

To avail of the Calamity Loan, the requirements are the same as that of the Multi-Purpose Loan with the addition that you are a bona fide resident of a locality that has been placed under a state of calamity.

Who are eligible for Pag-IBIG Housing Loans?

To be eligible for a Housing Loan, you need to have at least 24 months of contributions, must not be 65 years old and can pay before you turn 71 years old, has the legal capacity to have real property, and is a member in good standing.

What are the property legal documents needed for the Housing Loan application?

These are the Transfer Certificate of Title, Condominium Certificate of Title, Updated Tax Declaration for House and Lot, and Updated Real Estate Tax Receipt, whichever is applicable.

What are valid IDs accepted in Pag-IBIG?

The valid identification cards accepted for Pag-IBIG transactions include Company ID, Driver’s License, Government ID, GSIS eCard, IBP ID, OFW ID, OWWA ID, Passport, Postal ID, Seafarer’s ID, and Record Book, PRC ID, Senior Citizen Card, SSS Card, and Voter’s ID.

How do I withdraw my Pag-IBIG contributions?

You can withdraw your Pag-IBIG contributions whether you have availed or not availed of any loan once you are eligible to terminate your membership, you do not have any existing loan, and you have the minimum numbers of contributions depending on the type of withdrawal and account with Pag-IBIG.

How to Apply for PAG IBIG Loan Online – Conclusion

Pag-IBIG is created to benefit its Filipino members who contribute to the economy.

You can always avail of the loans whenever you need them.

Related posts:

4 Comments