Being able to check your Pag-IBIG contributions online is one way to make sure that payments to your account are posted.

You can check your personal and employer contributions through the Pag-IBIG website.

If you want to know how to check Pag-IBIG contribution online, check all the details in this article.

What is Pag-IBIG Membership?

Membership to Pag-IBIG Fund is required if you are a working Filipino in the formal sector, and you either have a membership to the Social Security System or Government Service Insurance System.

You can also be a voluntary member of Pag-IBIG if you are also a voluntary paying member of the SSS.

As long as you are a member, you can avail of the benefits and services offered by Pag-IBIG.

Why should I check my Pag-IBIG contributions?

You may have heard the unfortunate stories of hardworking Filipinos who discovered that their employers did not pay their contributions just as when they need it the most.

Remember that your Pag-IBIG contribution is also mandatory along with your SSS or GSIS membership, so it can also be an indicator on whether your employer pays your social security membership.

Being able to check whether your contributions were paid and posted would give you the peace of mind and the assurance that you can have those funds when you retire.

Also, Pag-IBIG contributions are required in order to avail the different loan products being offered.

How to check Pag-IBIG membership contribution online?

Follow these steps on how to check Pag-IBIG contribution online:

Step 1: Go to www.pagibigfund.gov.ph.

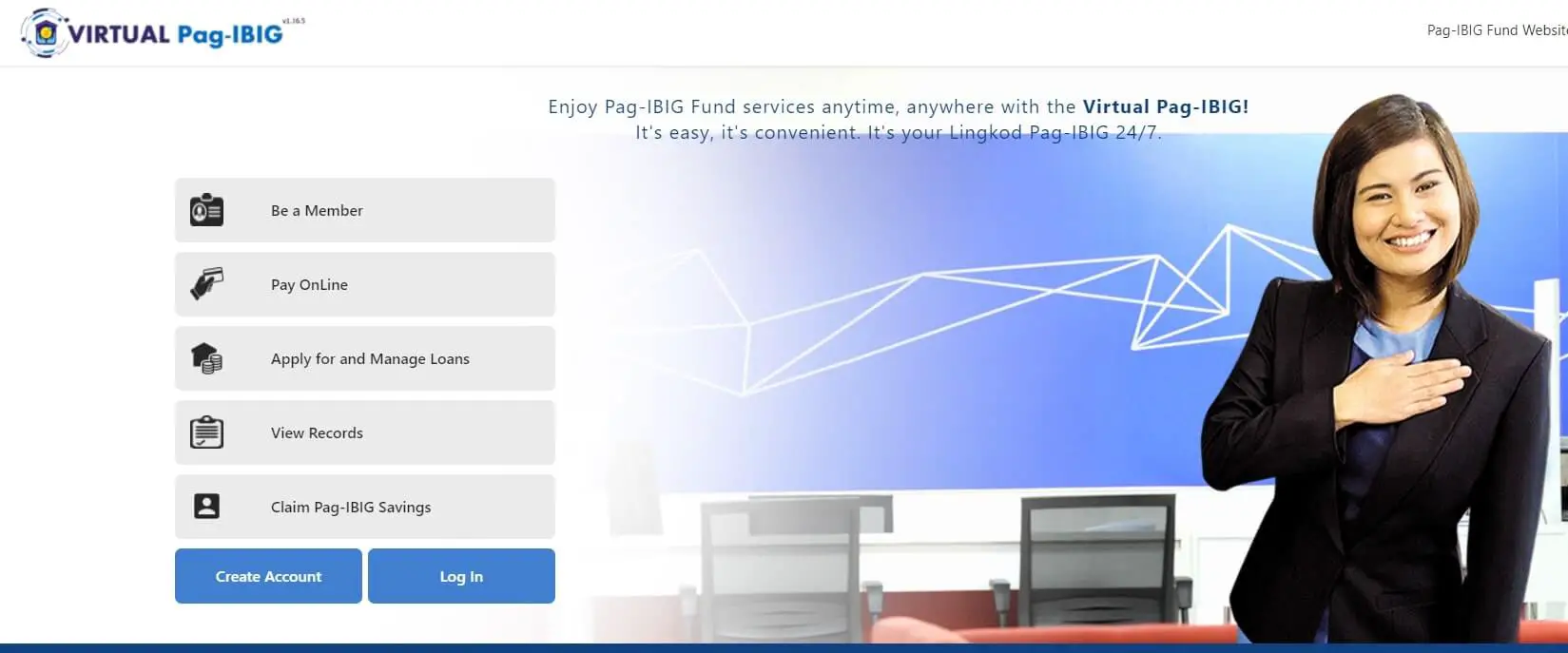

Step 2: Click the burger menu icon and tap the plus button beside Virtual Pag-IBIG.

Step 3: Select between For Members or For Employers.

Step 4: Tick the box on the Data Privacy Notice then click Proceed.

Step 5: Log in to your Pag-IBIG account.

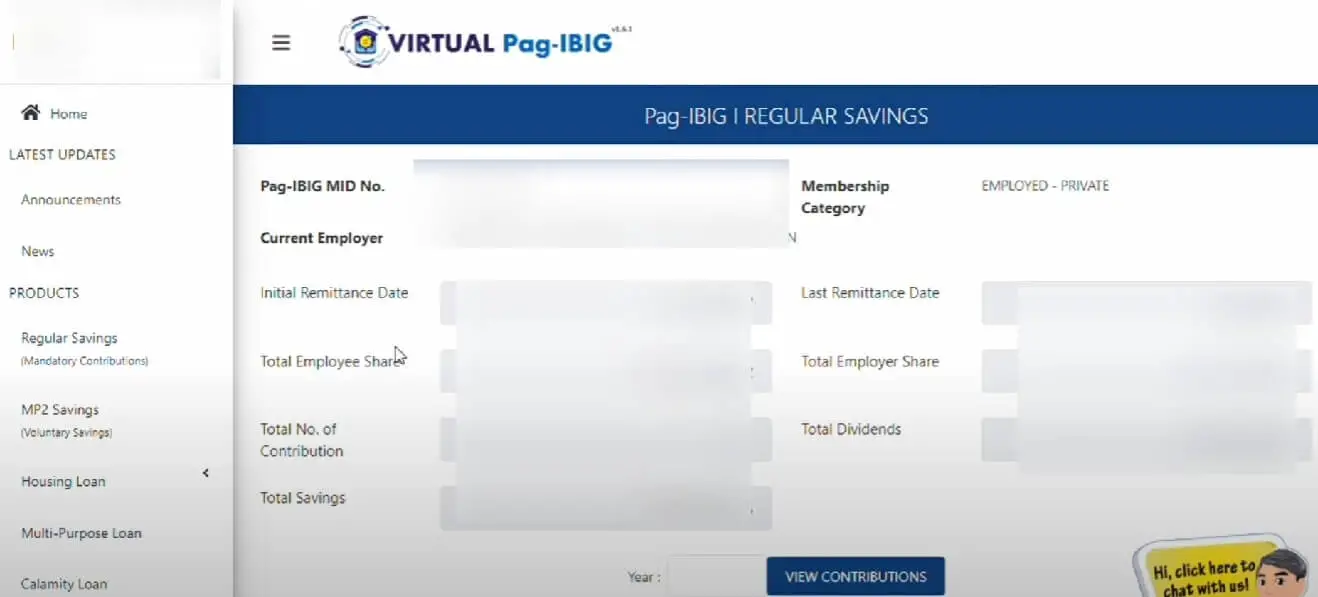

Step 6: Click the burger menu icon and look for your type of savings under Products.

Step 7: Enter the year where you want to see additional details.

You can now see relevant details such as your initial and most recent contributions, as well as your employer’s share, if applicable.

How to create a Virtual Pag-IBIG account

If you don’t have an online account yet, you can easily create one through these instructions:

Step 1: Go to https://www.pagibigfundservices.com/virtualpagibig/.

Step 2: Tap on the Log In or Create Account, then Create Account.

Step 3: Choose the Click Here button below your preferred option such as via your Loyalty Card Plus, nearest Pag-IBIG Fund branch, or for OFWs.

Step 4: Enter all the required information then click Proceed.

Step 5: Request for then input your OTP.

Step 6: Provide additional details such as answers to security questions and documents.

Step 7: Click Submit and go to the nearest Pag-IBIG Fund branch for your account activation.

What are the requirements in opening a Virtual Pag-IBIG account?

There are only a few things needed if you want to create a Virtual Pag-IBIG account:

- Pag-IBIG membership ID number or MID

- Softcopy of your Passport or 2 valid IDs, with file size of 1 megabyte or less each

- Working email address and mobile number

- Selfie with the Passport or valid IDs

When can I withdraw my Pag-IBIG Fund contributions?

You can finally withdraw all of your monthly premiums plus the earned interest after 20 years or 240 monthly contributions, or when you are already retiring.

Optional withdrawal is also allowable for those who have 180 continuous monthly contributions with no outstanding Pag-IBIG loans.

What is the difference between Regular Savings and MP2 Savings?

The Regular Savings of Pag-IBIG is the default contribution, and it is also mandatory.

On the other hand, MP2 only has a five-year maturity period, and you can apply for more than one at a time with a minimum monthly contribution of P500, and you must have 24 months of regular contributions or equivalent.

The dividends you earn from MP2 savings are also free from withholding tax.

Opting for optional or the voluntary contributions of MP1 or MP2 will greatly help not only in encouraging you to save money but also to increase your loanable amount.

How much are my monthly and employer monthly contributions?

If you are employed in the formal sector, and you are earning less than P1,500, you need to contribute 1 percent of that amount while your employer matches your contribution twice.

If you are earning more than P1,500 per month, you and your employer should each pay P100.

If you do not have an employer, you only need to pay a maximum of P200 per month.

The contributions must be paid to Pag-IBIG before the 10th day of the succeeding month.

Do I need to be a member of SSS or GSIS in order to be a Pag-IBIG Fund member?

Yes, you need to have either of the two in order to be a Pag-IBIG member.

This is because social security membership is compulsory for all working Filipinos whether as an employee or a self-employed individual.

Let’s say you have a business, you need to register to SSS since it’s also for your own benefit.

Once you have an SSS membership, applying to GSIS should be fairly easy.

How can I contact Pag-IBIG if I have additional questions?

If you want your question answered within one hour, you may call the Pag-IBIG Hotline at 8-724-4244 or 8-PAG-IBIG.

If you have simple or complex questions by other means, it may take 3 to 10 working days before you can get a reply, such as through the inquiry form at https://www.pagibigfund.gov.ph/contactus.html.

Alternatively, you can send an email to contactus@pagibigfund.gov.ph.

Snail mail is also possible through the Members Relations Department at 2nd Flr, JELP Business Solution Center, 409 Shaw Boulevard, Brgy. Addition Hills, Mandaluyong City, Philippines.

You can also send a mail to the Office of the Manager of your local branch.

Conclusion

Your Pag-IBIG Membership can be one of the most important memberships that can help you in times of need or on your retirement.

Make sure to check if your contributions are posted by visiting the Pag-IBIG website.

Read these next:

One Comment