As the Filipinos continuously adapt to the “new normal” due to the adversities brought by the COVID-19 pandemic, GCash reported that it reached its PHP 1 trillion transaction – a 254% year-on-year growth and equates to PHP 6 million transactions a day.

The number one mobile wallet in the Philippines under the Globe Telecommunication for more than 11 months said that it already has 33 million customers in its database from 20 million last 2019.

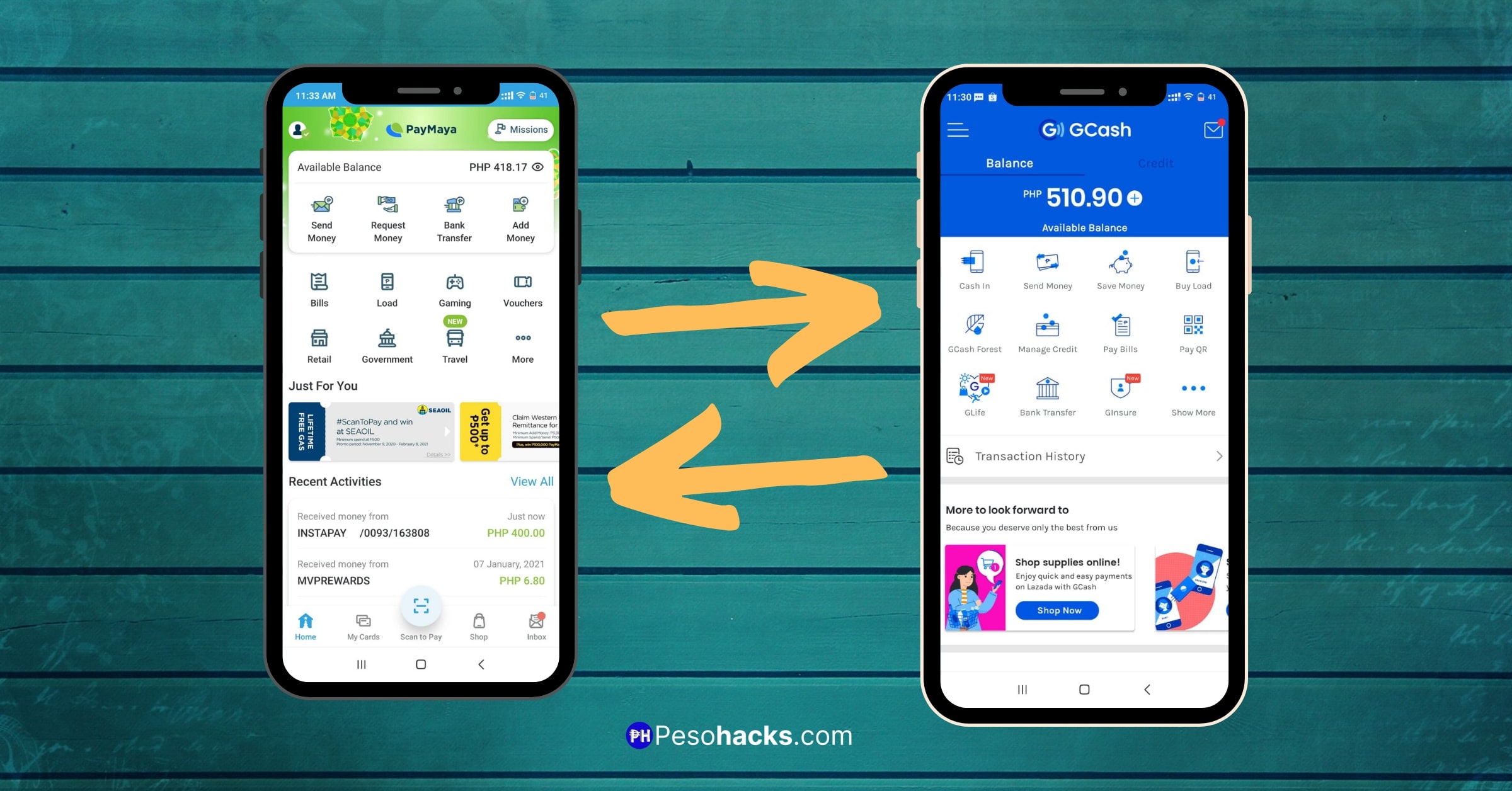

GCash, alongside PayMaya are two of the most popular e-wallets in the Philippines. PayMaya allows its users to have a virtual prepaid card that can be utilized for online shopping, booking flights, pay bills, send money, and purchase game credits. GCash, on the other hand, performs the similar function as well as serves as remittance hub for millions of its users.

Despite the rivalry in services provided by PayMaya and GCash as the two are under the Smart and Globe Telecommunication companies respectively, the PayMaya to GCash fee is free of charge so as to cater to the demand of the general public. Thus, these e-wallets allow users to send money from PayMaya to GCash (and vice versa).

Here’s a quick guide on how to send money from PayMaya to GCash.

Steps on how to transfer money from PayMaya to GCash

1. Open your PayMaya app and enter your login credentials.

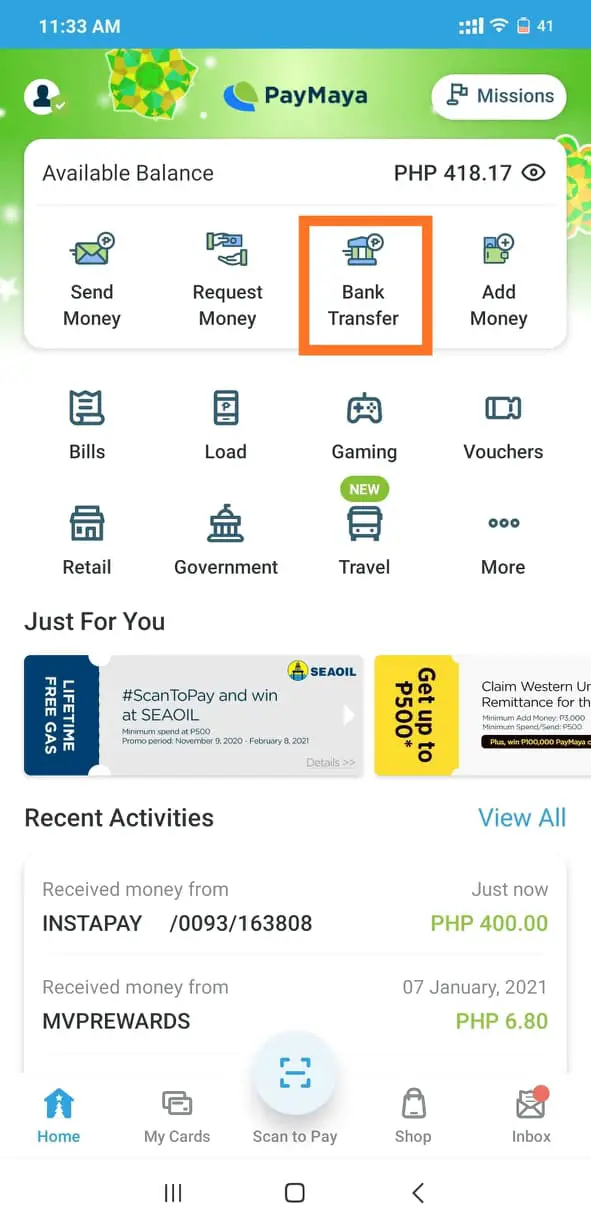

2. On the main menu screen of the app, select Bank Transfer > GCash.

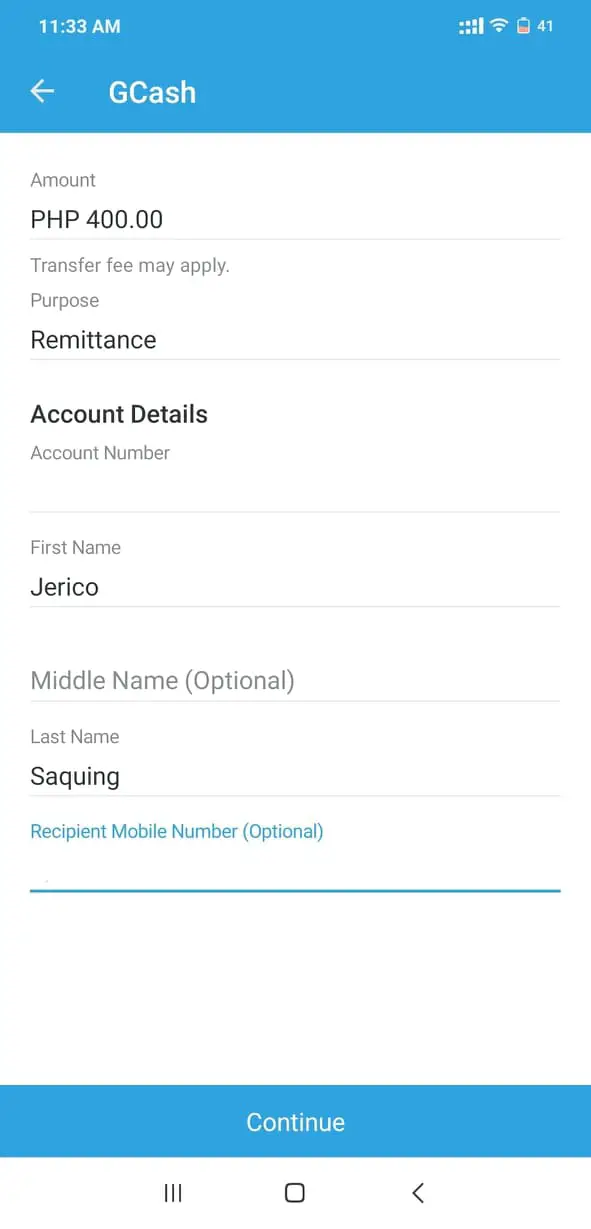

3. Provide the correct information such as the amount you wish to transfer, 11-digit number as your account number, name, and purpose, and then click “Continue.”

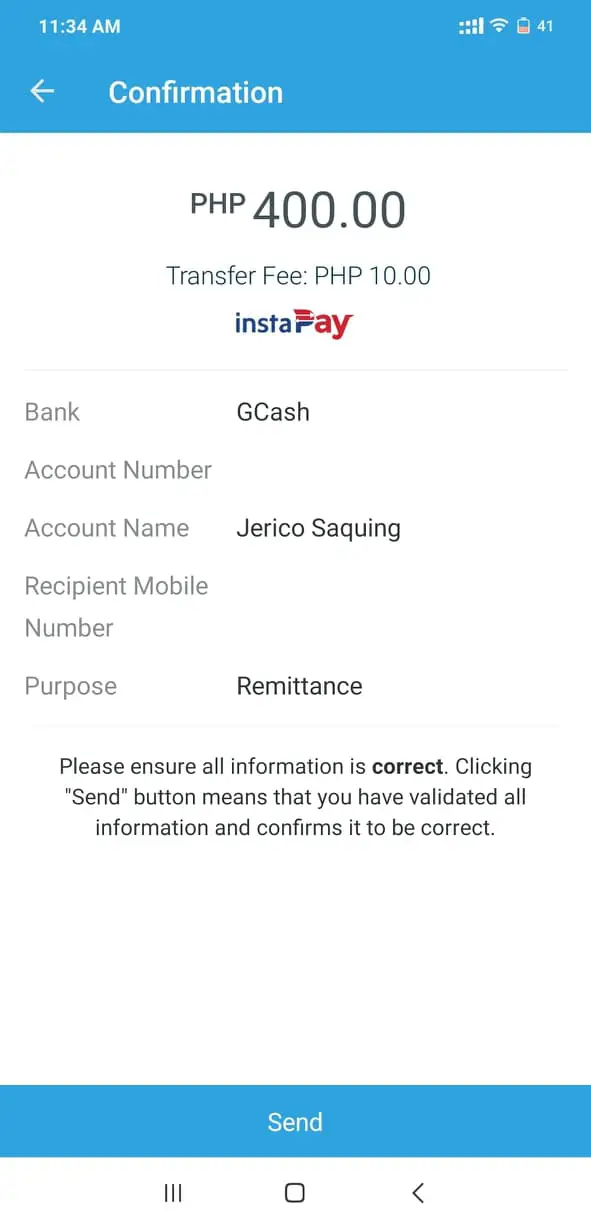

4. A confirmation message will pop-up entailing the details of the transaction created. If everything is correct, click “Send.”

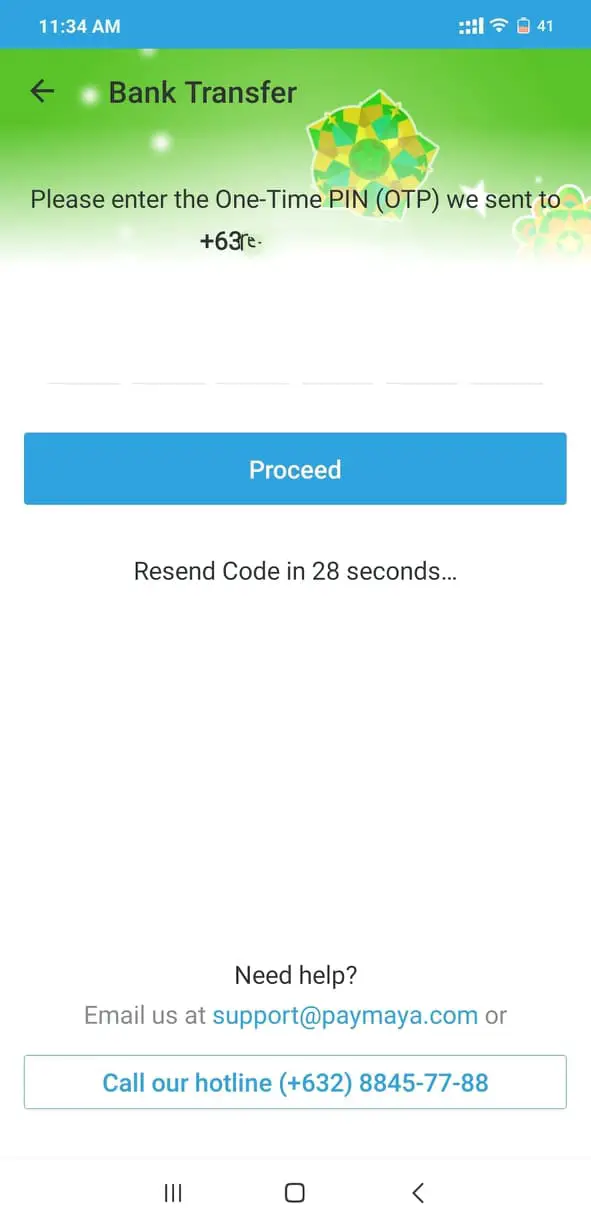

5. The mobile no. you’ve connected to your PayMaya account will receive a one-time pin. Enter this 6-digit pin in the app then click “Proceed.”

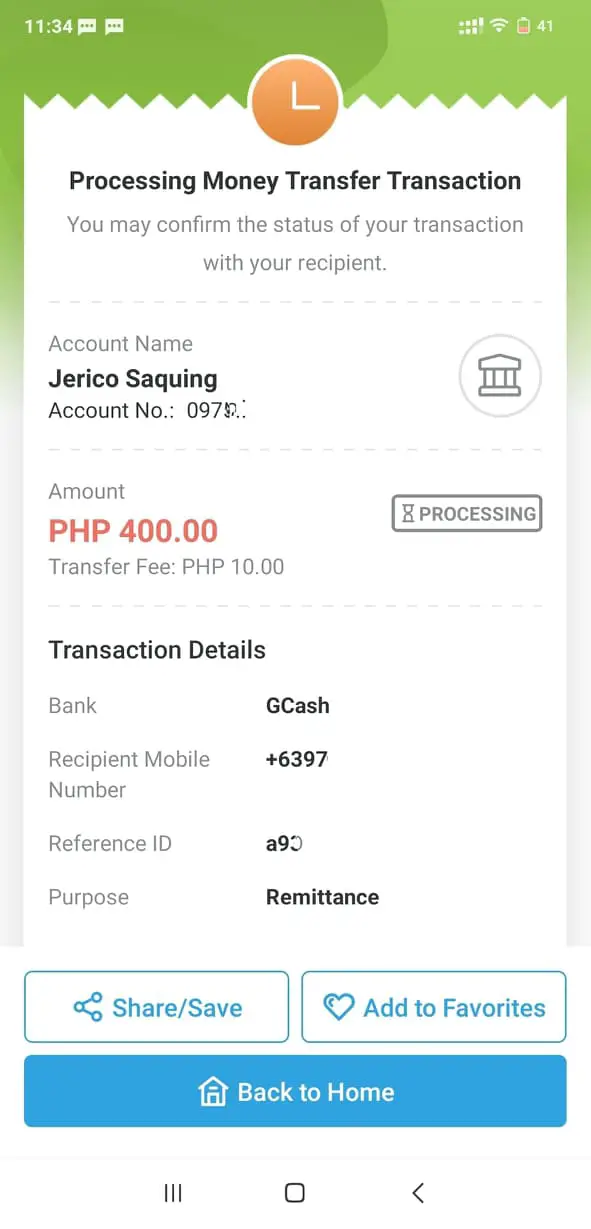

6. You will also receive a message entailing the success of your transfer from PayMaya to GCash.

7. In all your transactions with PayMaya, it’ll have a Reference ID which you may use just in case you’ll encounter problems with the transaction(s) you’ve made.

Steps on how to transfer money from GCash to PayMaya

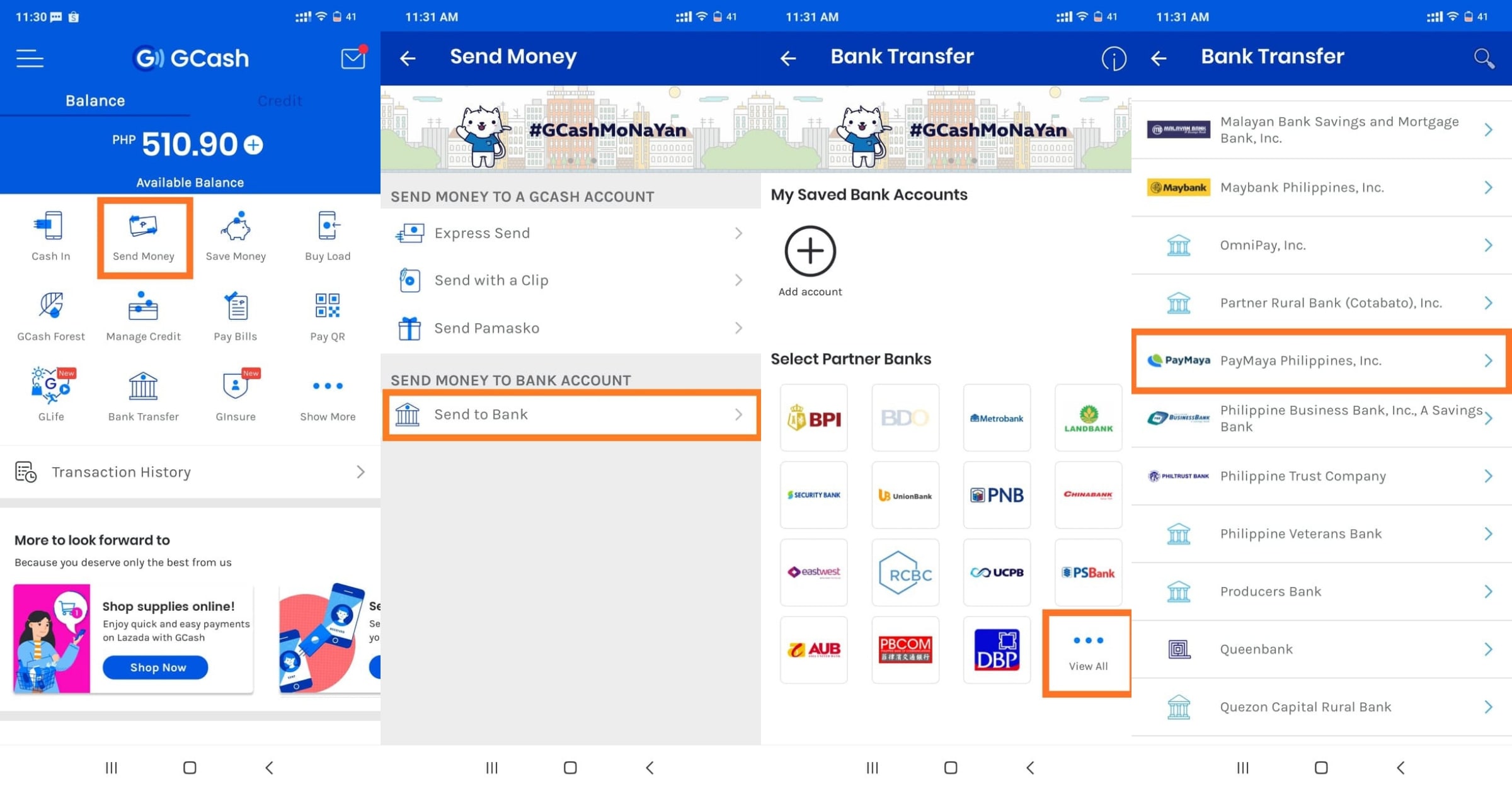

1. Open your GCash app and enter your MPIN.

2. On the main menu screen, click Send Money > Send to Bank and then scroll down to PayMaya Philippines, Inc.

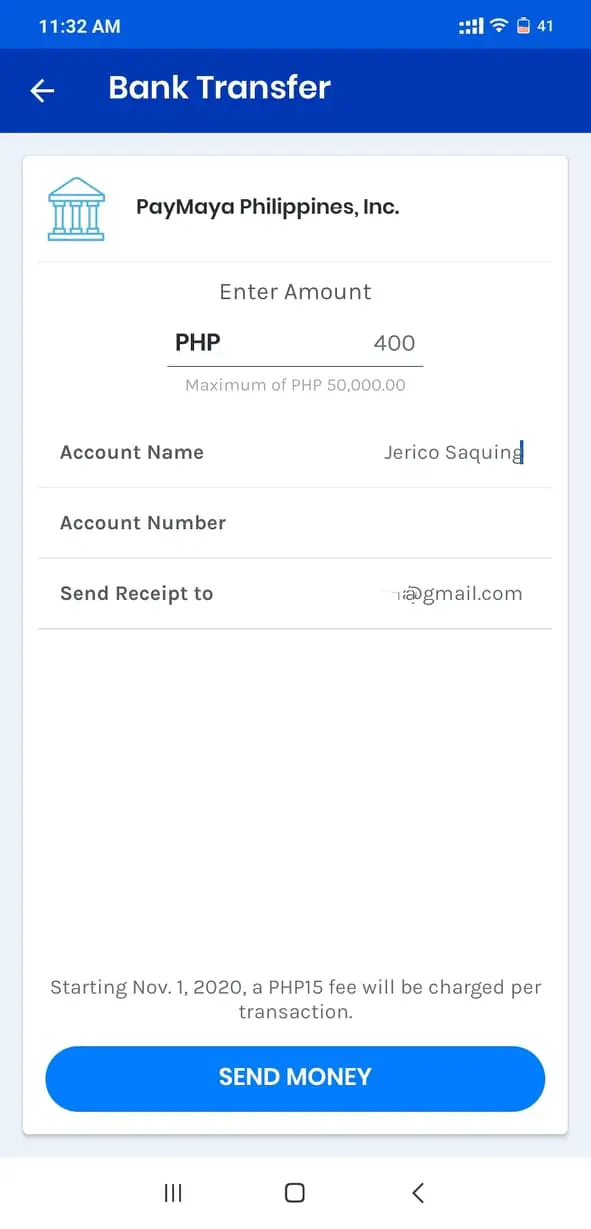

3. Indicate the amount you wish to send, the name of the recipient and account number, as well as email address (optional). The account number should be the mobile number registered in the recipient’s PayMaya account. When finished, tap “Send Money.”

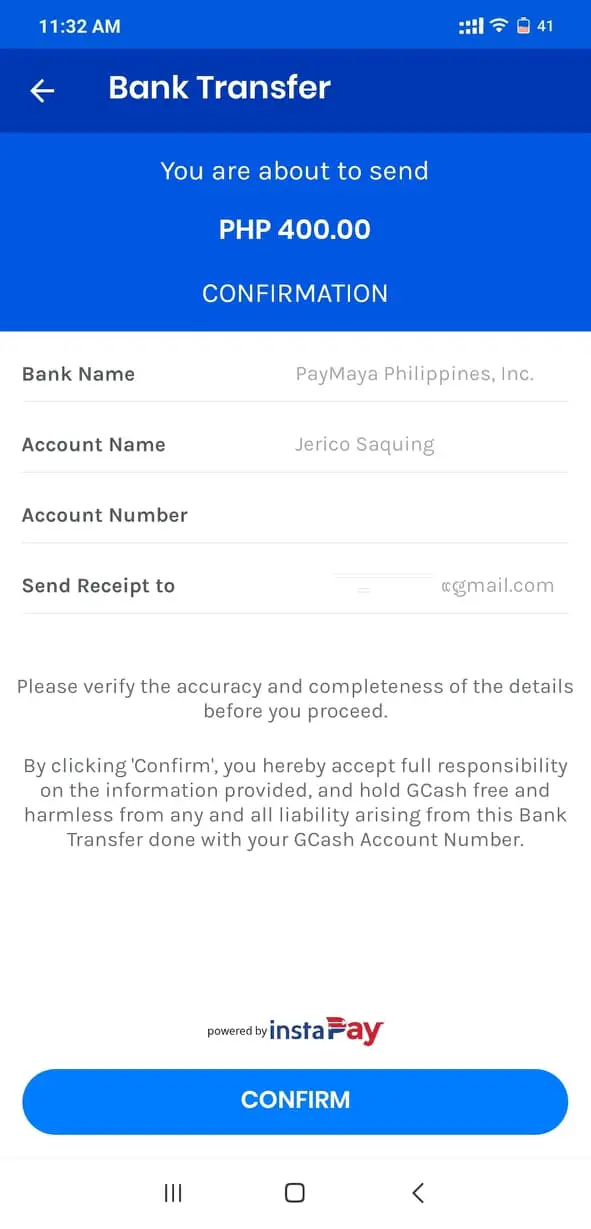

4. Re-check the information before clicking “Confirm” to complete the transaction.

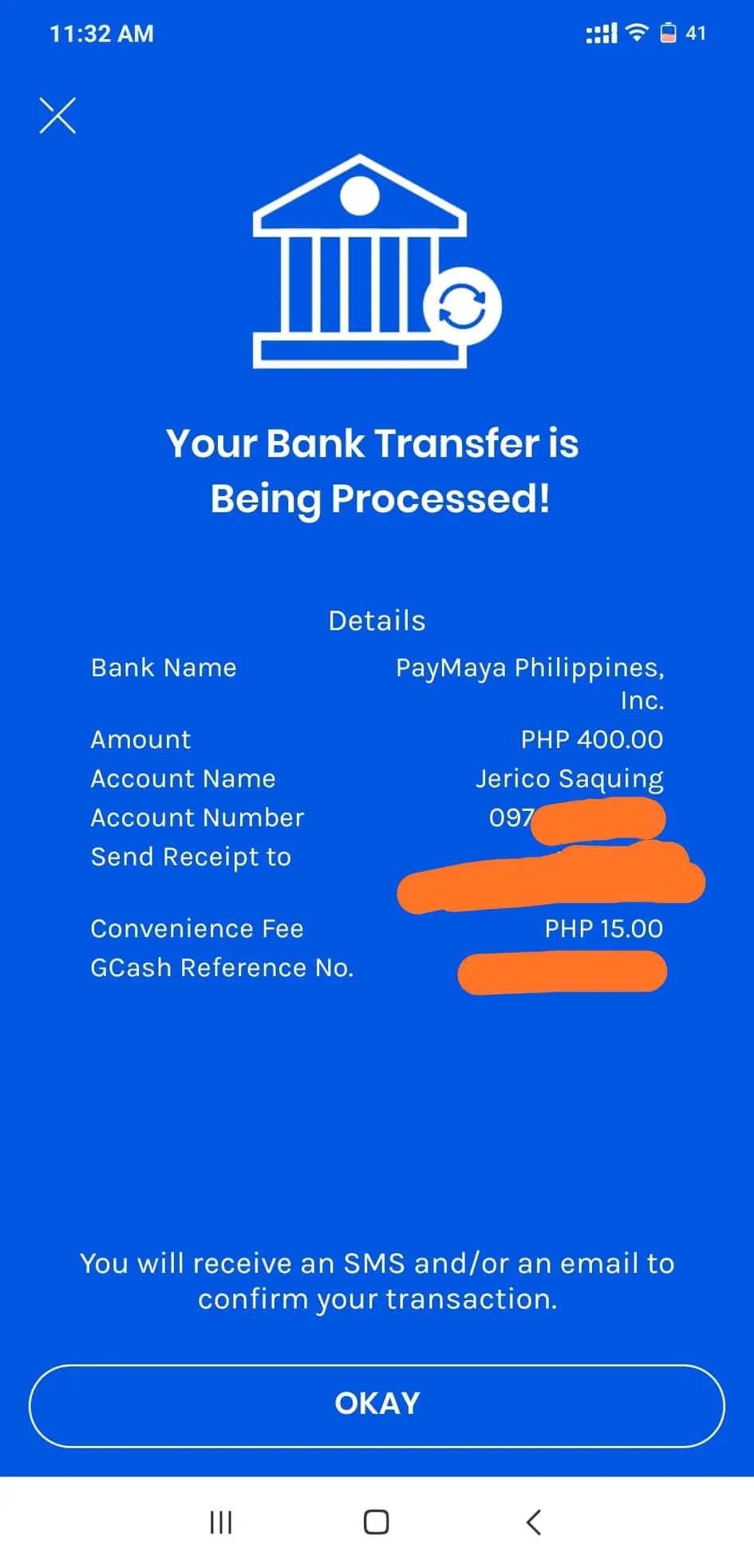

5. You will receive an SMS and email (if you’ve indicated your email address) as notification of your successful transaction.

6. You may check with the recipient if the PayMaya account already received the money.

7. Remember to recheck information you’ve provided as you can’t undo it once confirmed.

If you’ll experience concern(s) in your transfer, you may call the GCash customer service through 2882 or reach them in the app itself.

Why can’t I send money from PayMaya to GCash?

If you receive a notification that your transaction has failed, you may do the following steps:

- Check if you have stable internet connection.

- Re-check the information you’ve provided.

- Check the official website and social media accounts of PayMaya for any announcements of downtime.

- If there’s no reported downtime, give it a few minutes before trying to do another transaction.

- If you’re still unable to transfer money from PayMaya to GCash, you may contact the official customer support of the online money wallet through:

- Clicking the “Need More Help” at the app to send a message; or

- Send a message in the official Facebook account of PayMaya – PayMayaCares (ensure that the account you’re about to message has a blue Verified Account check mark).

How to download the PayMaya App

If you’re still new to PayMaya, here are the steps to register for a PayMaya account:

- Download the PayMaya app from the App Store (for iOS users) or Google Play Store (for Android users).

- Fill out the required information. Once done, tap “Continue.”

- Read through the Data Privacy Policy page then tap “Agree” to continue.

- A verification will be sent to you on your mobile number. Enter the number in the app then click “Verify.”

- Input my invitation code (285wit3) so you and I can receive free rewards

- Tap the “View Card” button and enter your address and birthday.

- Provide the required information under the Online Payment Card Number page. A confirmation will be sent to you for the verification of your PayMaya account.

To cash-in, here are the steps to add money to your PayMaya account:

- In your PayMaya account, tap “Add Money.”

- Select the Add Money Partner and follow the instructions to successful add money to your account.

- Adding money from selected partner is free as long as you do not exceed the monthly threshold which is PHP 10,000.00. If you exceed with the monthly threshold, there’ll be a convenience fee of 1%.

- There are also other PayMaya cash-in options such online and mobile bank transfer, via convenience stores, malls, and remittance centers.

Paymaya to GCash – Final Thoughts

Definitely, e-wallets is a handy tool for everyone – these advancements made it easy to receive and send money, even pay bills, buy and transfer load. If there are big changes the pandemic brought by most Filipinos, one of which is embracing the advantages offered by technology.

Sooner or later, digital banking will not just become a new normal, but a lifestyle that will be embraced by its consumers. This initiative will also open opportunities for the unbanked to have access to financial services offered by various financial institutions.

Moreover, there’ll be an increase on confidence of consumers to utilize the cost-effective and convenience offered by e-wallets and other relevant digital transactions.

If this post was helpful, you’ll love these too:

We’re I can find 16 digit account number of gcash or Paymaya

Hi Mark! The account number that you need to input if you want to send money from Paymaya to GCash and vice versa is the mobile number you used to register your GCash/Paymaya 🙂