In forex trading, attracting new clients is important for a brokerage’s success, especially during a crisis.The forex market keeps evolving with new trading platforms, mobile apps, and tools for analyzing the market being introduced regularly. These changes not only affect how traders work but also increase their expectations from brokers, making it a critical consideration for those who want to start a forex brokerage.

Forex brokers must update their strategies to stay competitive, this means not only understanding new technologies but also using them to offer more to potential clients. The main goal is to show how your brokerage can use these tools to provide a better trading experience, even during a crisis. This introduction leads to a more detailed discussion on strategies that can help forex brokers succeed in attracting new customers during difficult times.

Bonus Offers

During economic crises, forex brokers can effectively draw new clients by presenting attractive bonus offers. A common strategy is offering a 50% deposit bonus, where if a client deposits $1,000, the broker adds an additional $500 to their trading account.

Another powerful tool is the no-deposit bonus. Brokers might offer a $100 no-deposit bonus, allowing new traders to start trading without any initial investment. This approach is particularly appealing to newcomers who are wary of risking their own funds during volatile market conditions.

The ‘refer-a-friend’ bonus, where existing clients receive a $200 bonus for every new client they refer who opens an account and meets certain deposit criteria. This not only incentivizes current clients to promote the broker but also helps in expanding the client base organically.

However, a too-generous bonus might impact the broker’s financial stability, while a less attractive offer might not be effective in drawing clients.

MAM/PAMM Investment Platforms

Copy Trading

Copy Trading is a feature in forex trading that allows less experienced traders to automatically replicate the trades of more seasoned investors. Users select a trader based on their performance and risk profile and allocate a portion of their capital to follow their trades. This process is automated, proportionally mirroring the selected trader’s moves in the user’s account.

It’s a passive approach that lets novices benefit from the experience of veteran traders, offering a learning opportunity through observation. Particularly useful in volatile markets, it reduces the need for extensive market knowledge but still involves inherent risks. Additionally, it provides an avenue for experienced traders to earn extra income by being copied, making it attractive for a wide range of market participants.

PAMM (Investment Fund)

PAMM platforms function as a collective investment solution in forex trading, where investors allocate a portion of their funds to a professional trader’s account. They enable investors to allocate a percentage of their capital to a professional trader’s account, allowing them to benefit from the trader’s strategies without actively trading themselves. These funds are pooled together and managed by the selected trader, who makes trades on behalf of the entire group. Profits and losses from these trades are then distributed among investors in proportion to their investment.

This system is particularly attractive during economic downturns, offering a detailed view of the trader’s performance history and risk management strategies, thus providing a reassuring and managed trading solution for those wary of the uncertainties of independent trading.

МАМ (Multi Account Manager)

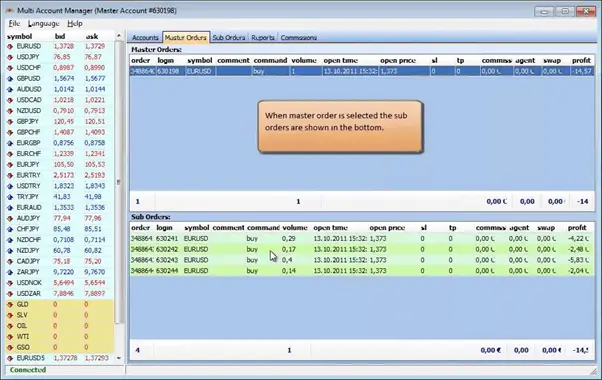

The MAM platform is designed for professional traders who manage multiple client accounts simultaneously. It allows these traders, or account managers, to execute bulk orders on all accounts with a single click, using various types of allocation methods such as by percentage, by proportional equity, or by balance. Each client account still remains individually owned, providing transparency and control to the client over their funds.

The MAM system aggregates all client funds into a master account controlled by the manager, enabling efficient trade execution and management. This setup is particularly appealing in times of crisis, as it provides clients with the expertise of experienced traders to manage their investments, which can be a more reassuring option than trading independently. The MAM platform’s ability to handle multiple accounts with varying strategies and risk profiles makes it a versatile tool for fund managers and an attractive feature for brokers looking to attract both skilled traders and clients seeking managed trading solutions.

IB / Affiliate Management Platforms

Effective IB (Introducing Broker) or affiliate management platforms are crucial for forex brokers aiming to expand their client base during a crisis. These platforms empower affiliates or partners to refer new clients to the broker, often in exchange for a commission or other incentives.

By providing partners with robust and transparent affiliate management tools, brokers can tap into a wider network, reaching potential clients through trusted sources. This strategy is particularly effective in times of uncertainty, as referrals from reliable affiliates can greatly enhance a brokerage’s credibility and appeal to cautious investors.

Each of these solutions not only provides a unique way to engage different types of investors but also helps in building trust and confidence among clients in a volatile market. Ultimately, the key for forex brokers to thrive in attracting new clients during a crisis lies in their ability to adapt to market changes, understand client needs, and offer flexible, transparent, and efficient trading solutions.