Have you ever tried saving money only to give up after a few days or weeks? Or perhaps you’ve tried an ipon challenge but failed?

Don’t worry as you’re not alone. A lot of us struggle with the traditional way of saving.

But you don’t have to do things the old-fashioned way. Nowadays, you can make savings more fun by participating in an ipon challenge! To make things easier for you, I’ve compiled 9 of the most effective ipon challenges I can find! I also created some free templates you can download.

Stick around till the end if you want to know how to actually COMPLETE an ipon challenge!

1. 52-week ipon challenge

What is it?

You’ve probably heard of this ipon challenge as it’s popular here and abroad. But if you didn’t know, it was created by Kassondra Perry-Moreland in 2013 through her Facebook group. In her group, she taught people this now a popular method of saving money.

How does this work?

Basically, the way the 52-week ipon challenge works is by increasing your saving input weekly. For instance, you start the week by saving ₱50, then next week you’ll save ₱100 and so on. This will go on until the 52 weeks have been completed.

How much can you save?

If you follow the popular chart that starts increases your savings weekly by ₱50, you should save ₱68,900 in total. This isn’t bad for 1 year and 1 month of saving, right?

But the good thing is, you can always add or lessen the amount you start with so you won’t feel extremely pressured. For instance, you can try saving ₱1 in the first week, then ₱2 the next and so on.

Why is this effective?

The 52-week ipon challenge was created so that people would build a good saving habit. The challenge starts easy and it gradually gets bigger every week – which is a great way for savers to get accustomed to saving.

Aside from that, it makes us much more likely to finish the challenge since we have a goal we follow as opposed to randomly saving.

Things you need

For this ipon challenge, you’ll need the following:

- A goal

- Savings jar/piggy bank

- 52-week ipon challenge sheet

If you’re wondering as to where to buy an Ipon Challenge alkansya, just head on to the link. It’s only ₱80!

2. Invisible 50 challenge

What is it?

As the challenge name indicates, it’s an ipon challenge where you save every ₱50 you get. This has become a popular challenge in the past years in the country as it’s unique.

How does this work?

The way this savings challenge works is that you save every ₱50 bill you have. For example, you buy a Jollibee meal and you get a two ₱50 bill as change – you’ll have no choice but to put them in your savings

How much can you save?

If you promise to save every ₱50 bill that you encounter, then you can save a huge amount in just months. But the only downside of this ipon challenge is that it’s dependent on the number of times you encounter a ₱50 bill.

But you can always try changing it to ₱20 or even higher if you want. At the end of the day, it all depends on you.

Why is this effective?

If you’re looking for a new ipon challenge this year, then this challenge may just be what you’re looking for. It’s random yet it’s consistent. This is because you don’t have a choice but to save when you come across a ₱50 bill.

But of course, its effectiveness is still dependent on how consistent you are at it. Be sure to stick to it until your goal is completed.

Things you need

For this ipon challenge, you won’t need a lot of things. You’ll just need a piggy bank and a goal/time frame. For example, you’ll promise to save every ₱50 bill you get in 5 months. Or you can set a target goal of saving a total of ₱30,000 and you won’t stop until that goal is finished regardless of the time it takes.

3. Loose change challenge

What is it?

A variation of the ₱50 savings challenge, in this one, you’ll save every coin you get. This is the perfect ipon challenge for those that regularly receive coins or students that don’t have a lot of budget.

How does this work?

In here, you’ll promise to keep every coin you get as change. Whether it’s ₱1, ₱5, ₱10 or centimos, you’ll save them all. This means that you can’t use your coins to buy anything – they’ll all go to your savings.

How much can you save?

Compared to other ipon challenges here, you’ll probably save less in here. But your total savings still depends on how consistent and how long you keep at it. As they say, “Di ka makakabuo ng 100 kung walang piso”. This statement is the motto of this savings challenge.

Why is this effective?

A lot of pinoys have a bad habit of neglecting their coins – either they throw it or not. You can even find a lot of them on the streets or under the cabinets. But if you just take some extra effort of keeping your loose change, it can save you someday.

The beauty of this ipon challenge is that it teaches us to be more mindful of our money no matter how small it may seem. Because when we need it most, we can be assured that we have something to get by.

Things you need

You don’t need a lot for this saving challenge, just some piggy bank and your loose change.

4. Envelope Savings Challenge

What is it?

The envelope savings challenge is exactly how it sounds – it features envelopes. This challenge has been popularized abroad with people saving thousands of dollars in just a few months.

How does this work?

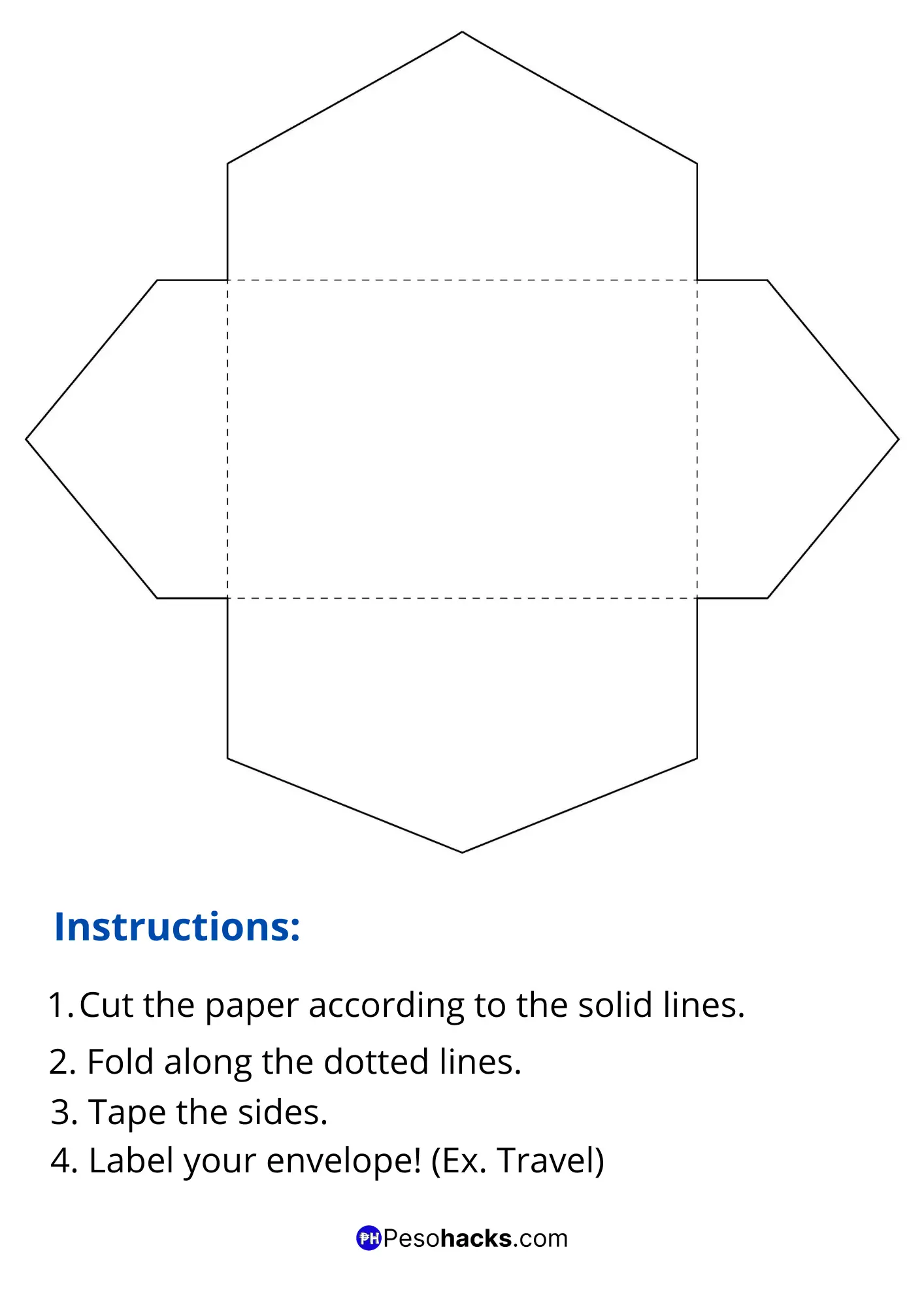

To do this challenge, you just need 1-10 or more envelopes which you will label. You’ll label each envelope according to your goal (ex. travel, house, car etc.). Then you’ll set a specific time frame to complete the challenge. You can set it for several months, a year or however long you like. Lastly, it’s important to also put the amount you want to save for each envelope.

How much can you save?

Since you’re going to put paper bills in the envelopes, you can save thousands by the end of the challenge. But ultimately, it all depends on what your target savings are and how long you’re planning to do it.

Why is this effective?

Unlike the normal way of saving, here you’ll be more motivated to complete the challenge since you’re saving for a specific goal. By specifying your savings as much as possible, it’s easier to save.

Things you need

For this savings challenge, you’ll just need some envelopes. If you don’t have one I’ve created this envelope template you can print and fold to create DIY envelopes!

Download the Envelope Savings Challenge template here!

5. 52-week dice game challenge

What is it?

The 52-week dice game challenge was made as an alternative to the 52-week savings challenge. In this one, instead of saving in increments, the amount you’re going to save will be random making this one of the best ipon challenge!

How does this work?

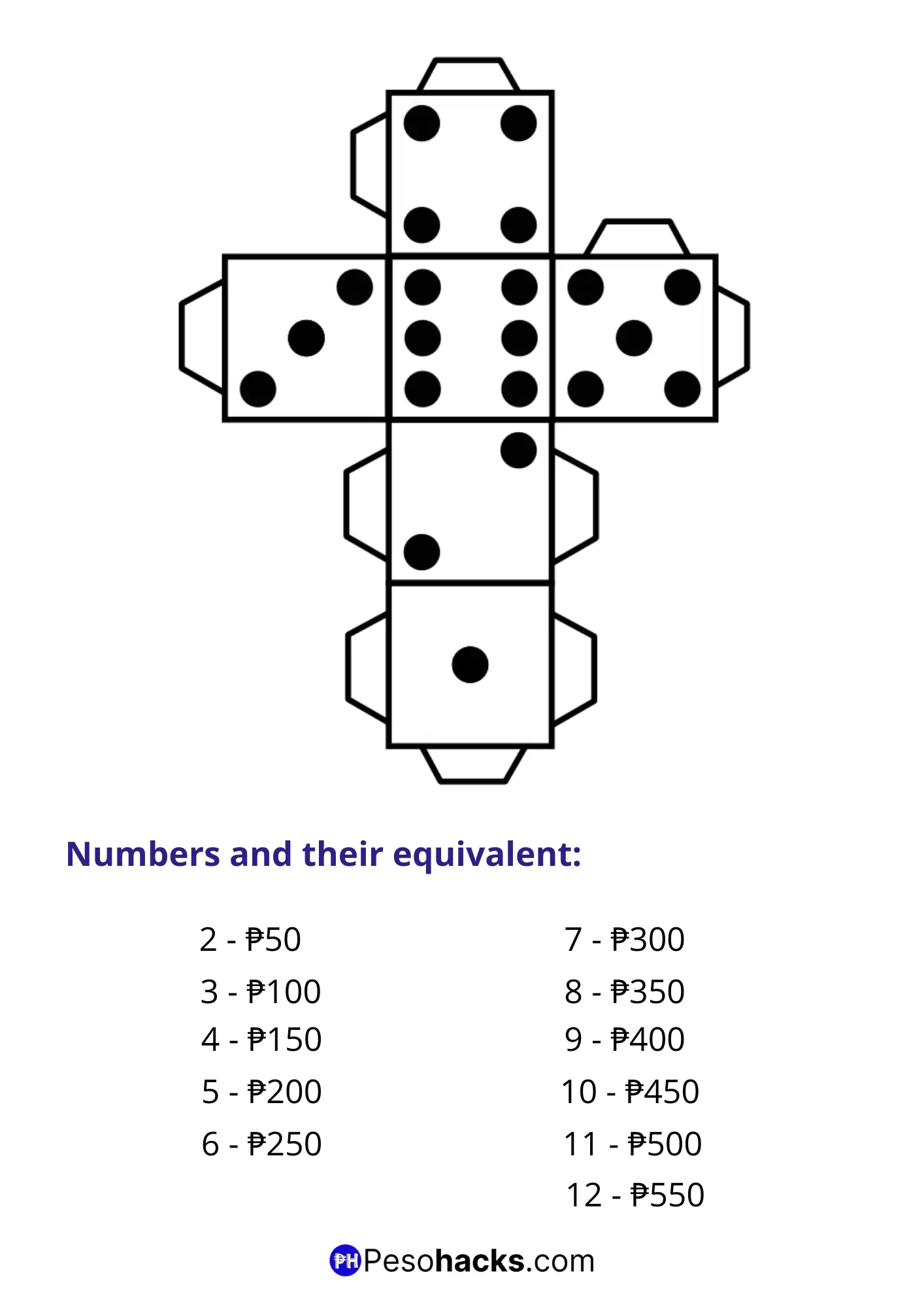

Basically, instead of increasing your savings to fixed amounts every week, you’re going to save them randomly using 2 dice. The total number that you can get will have it’s corresponding amount. Each week, you’re going to roll the 2 dice. Then, you must save that amount which will last for 52 weeks.

How much can you save?

Since the amount you’re going to save weekly is random, I can’t say for sure how much you can save after this challenge. But I assure you that after this, you’re going to have saved thousands of pesos!

Why is this effective?

The 52-week dice savings challenge is an effective way to save because it’s so much fun! Instead of just saving fixed amounts of money, you’ll be looking forward to rolling the dice each week. This sense of surprise is what makes this challenge so interesting.

Things you need

For this ipon challenge, you’ll only need 2 dice and a piggy bank. To make things easy, I’ve created this completely free downloadable template you can use to create your dice. Take note that you need to print 2 copies of the dice to make 2 dice. It also indicates the amount you need to save in regards to the number in the dice. But if you want to change the amounts to better accommodate your finances, feel free to do so!

Download the 52-week Dice Game Challenge here!

6. NO spend day challenge

What is it?

The No spend day challenge isn’t your typical savings challenge. In this one, instead of saving money, you will save money by not spending anything! It sounds complicated yet so simple. Read on to know more.

How does this work?

In this one, you’ll just need to select a day in a week where you’ll not spend a single peso. This can be difficult to do on a weekday so it’s recommended to do it on the weekends. You can just stay at home and play with your family or do things that don’t cost anything. For food, you can cook whatever you can find in the kitchen.

Basically, the goal is to not spend a single peso in a day or to at least keep it close to zero if possible.

How much can you save?

You might think that you won’t save much by doing this, but you’ll find that this isn’t true once you try it. While I can’t say how much you can save by doing this, I’m sure that you can definitely keep hundreds and even thousands of pesos even just a day of doing this challenge.

Why is this effective?

This challenge doesn’t focus on the amount you’re going to save. Rather, it teaches us to focus more on things that truly matter – our family, relationships, and ourselves. There are a lot of meaningful things you can still do without spending anything.

Doing this challenge once, or twice a month can greatly help with building your financial habits in the long run. Try to influence your loved ones with this challenge also.

Things you need

Since this isn’t your typical ipon challenge, you don’t need anything to do this. In fact, that is the point – that you don’t need to spend money to have a great time.

7. Holiday savings challenge

What is it?

As pinoys, we all know that the holidays particularly the Christmas season is huge in here. So much so that we even start preparing for it as early as September each year. We also know how generous most people can be especially when it comes to giving gifts.

But oftentimes, we find ourselves running out of money to give for gifts during the holidays. Whatever the reason is, some people even resort to getting into debt just to save face to their inaanaks.

But this shouldn’t be the case anymore. The holiday savings challenge was created for you to be prepared financially when Christmas comes.

How does this work?

Some people save money for the holidays while the majority don’t. But if you’re planning to be generous around Christmas, you need a financial plan.

The holiday savings challenge is simple – you just need to save money every month until you reach December.

How much can you save?

In this ipon challenge, you’re the one going to set the goal as to how much you’ll be needing for the holidays. It could be ₱5,000 or ₱20,000 – you just need to complete it.

Why is this effective?

Most pinoys spend a lot of their money on Christmas. But oftentimes, even their bonuses can’t cover these expenses. The holiday savings challenge is effective because you are allocating a little bit of your monthly budget to the Christmas season slowly.

This way, you won’t need to borrow money come Christmas time – or worst, not give a gift at all!

Things you need

For this savings challenge, you just need the following:

Target amount – For this to be truly effective, you need to set a target amount – this is the total amount that you want to save by December. Then, you’ll also need to make a plan as to how much you’re going to put each month into this savings goal.

For example, you want to save ₱7,000 for the Christmas season. You can then plan to save at least ₱583 each month if you’re going to start saving in January.

An early start (as much as possible) – As mentioned, this savings challenge works best if you start in January. This way, you won’t feel the burden too much. But it could also work in any month except for December.

Savings jar/separate bank account – Ideally, you should put the amount you’ll be saving here in a separate bank account. Better yet, you can put it in a passbook. This will reduce the chances that you’ll be tempted to spend it before December. But if this isn’t possible, you can always just use a savings jar.

8. The Bisyo savings challenge

What is it?

Countless people die due to the bad effects of vices every day. Yet a lot of people still show no signs of stopping. I’m not saying that people who have vices are bad. But if you’re truly concerned about your health, you’ll do something about it.

The Bisyo savings challenge is the perfect ipon challenge for those who want to quit their vices and save money at the same time!

How does this work?

From its name alone, you can probably guess how this works. Whenever you feel the urge to give in to your vice (ex. smoking, drinking alcohol etc.), you just need to save the money you’re going to spend.

The great thing about this is that you don’t even need to have the vices above to do this challenge. Even if you just have some addictions that you want to stop, you can do this.

How much can you save?

The amount of money you can save depends on how many times you give in to your bisyo. You can save up to hundreds per month or you can go to the extreme and save ₱1 million just like this OFW! Neil Ryan Lorenzo is an OFW in Saudi Arabia when he saved a million in 3 and a half years just by quitting smoking and being disciplined.

His inspiring bisyo ipon challenge story has been all over social media this year which also inspired countless Filipinos to do the same.

Why is this effective?

What makes this savings challenge work is the fact that you’re rewarding your future self and saving your present self. Yes, you’ll probably suffer a lot especially in the first few weeks of doing this, but if you have something bigger than the vice – you can overcome it.

Things you need

You just need a few things to do this ipon challenge. First, identify your vices. It can be the most obvious ones such as smoking, gambling and drinking alcohol or addictions such as overspending.

Then, you just need a piggy bank or savings account where you’ll put all the savings. Ideally, you should track your savings so you will be motivated to continue.

9. The Bingo Savings Challenge

What is it?

We all know that Pinoys love bingo. It’s played every time there’s a gathering. Because of this, I found an idea from Pinterest where they created this bingo savings challenge.

How does this work?

This bingo ipon challenge I created works a little bit different from your usual bingo games. Here, you just select what amount you’re going to save according to the bingo card. There are different amounts in here ranging from ₱1 to ₱1,000.

How much can you save?

This ipon challenge can be done in just 24 days. If you complete it, you should have saved ₱5,000 by then. But you can always create your own card with their own amounts to match your finances if you want. You could set a target goal of up to ₱20,000 or more if you like.

Why is this effective?

Who doesn’t love bingos? This ipon challenge is effective because it makes saving money so much fun.

If you want to make it even more enjoyable, you can host a contest with your family to see who can finish the goal. The winner/s can be given monetary prizes or any other kinds of prizes you wish. This should motivate them to save using this ipon challenge!

Things you need

In this savings challenge, you’ll only need this customized bingo card I created and a piggy bank.

Download the Bingo Savings Challenge Card here!

How to Actually Complete An Ipon Challenge

Be disciplined

Here’s the truth, it doesn’t matter how many ipon challenges you try – if you’re not disciplined, you won’t finish them. It might sound harsh, but this is the problem of many who start these challenges.

Even I find it extremely difficult to complete any ipon challenge but I do it anyway. If you stick to these challenges, your discipline will grow which will make it easier to manage your finances as a whole.

Have a goal

A common mistake that most of us make when starting an ipon challenge is not having a goal. In whatever savings challenge you try; you should always have a goal in mind. Whether it be for your future house or for a business idea, you would be more motivated to save if you know what you’re saving for.

Involve your family

Good money management starts with you. But it shouldn’t end with you. As much as possible, try to involve your loved ones in these ipon challenges. I’ve listed these ipon challenges so that you can have fun saving money with your family.

Earn more money

One of the fastest ways to save more money is to earn more money. It sounds common sense but it’s true. Think about it, you can’t expect to save millions if you’re just earning minimum wage, right?

But if you suddenly have the ability to earn more money, you can definitely save more if you use one of the ipon challenges here. However, we all know that it’s hard to earn money in our country. But what if I tell you that you don’t need to go abroad to earn P50,000 or more monthly?

It’s called becoming an online freelancer. Being a content writer, I earn P40,000/month on average. Imagine just how much you can save with this amount!

If you want to know more about this, read my helpful posts here to start:

- How to Work at Home in the Philippines (Even as a newbie!)

- 19 of The Most In-Demand Online Freelance Jobs in 2020

- 199Jobs Ultimate Guide & Review (How I Made ₱30K!)

Try different ipon challenges

What may work for others may not be for you. That’s why I’ve listed the best ipon challenges you can try. If one doesn’t work, try another. But just be careful of starting them all without actually finishing one! Or better yet, read down below!

Top 4 Free Ipon Challenge Apps

If you want a more digital approach to savings, why not try one of these Ipon Challenge apps? I’ve personally used these so I know it works just as well! My personal favorites are the My Ipon Challenge and Diskartech. Don’t forget to put my invite code (AASN5516) so you and I can earn money upon registration.

- My Ipon Challenge: Piggy Bank & Savings App

- Diskartech (Invite code: AASN5516)

- Ipon: 52 Weeks Money Challenge

- Ipon Master

Conclusion

I hope these ipon challenges can help you achieve your financial goals. Just remember that these challenges only work if you complete them. What’s your favorite out of all of them? Let me know in the comments below!

If you like this blog post, you’ll like these too:

2 Comments