Note: This story first came out in the Facebook Group Piso Ko, Ipon Ko. With Florie Mae’s permission, we featured her full story in this blog.

We all know that saving money is hard.

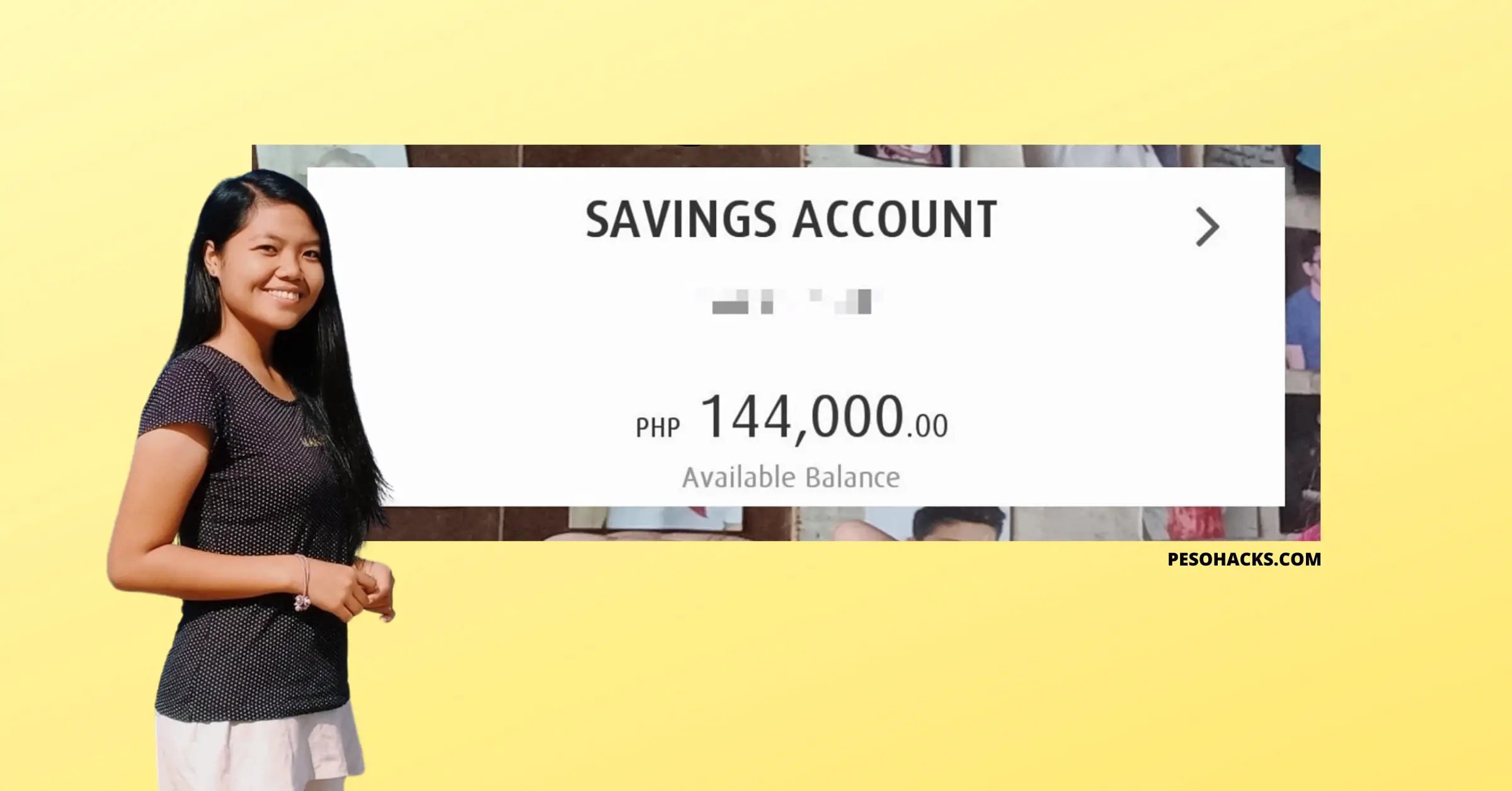

But would you believe me if I told you that a 20-year-old Filipina saved P100 thousand while studying?

You might say that it’s impossible.

Or say that she’s probably rich in the first place.

Or worst – say that it’s not a big deal since this isn’t something new anymore.

You’re right, this isn’t something new. There have been many people who are younger and have more savings.

But that’s not the point.

If you’re 20 plus years old right now and you still don’t have savings, you don’t have a right to say these things.

If that’s out of the way, let’s find out how this Filipina saved P100 thousand plus while studying!

Stick around till the end to know her top 5 tips!

Her Story

Florie Mae Malapit is a 20-Year-Old 2nd-year student studying at a State University.

She shares that her P100 thousand plus savings started when she was in Senior High school up to now.

We all know that saving money isn’t easy. This is especially true for students. But for Florie Mae, it just came down to discipline and some tips.

Whether you’re a student or not, we can all learn something from Florie’s saving story.

Fortunately, she even shared her top 5 on how she saved P100 thousand plus as a student below!

Tip#1: Be Thrifty

Don’t live beyond your means. This is a statement that we often see and hear everywhere.

But what does it really mean?

For Florie, aside from saving your money and bringing your own food to school, it’s the power to say “No”.

When you don’t have the budget to eat outside, learn to say “No” to your friends.

Peer pressure shouldn’t get in the way of your financial freedom!

Aside from that, you also need to monitor your expenses.

Here’s her ultimate savings formula that you should follow: Allowance – Savings = Expenses.

Here’s what her weekly allowance looks like in case you’re wondering:

Weekly Allowance = P800 – P1,000

- Groceries/Food allowance = P300-P350

- Transportation = P200 (House to dorm)

- Load allowance = P100

- Savings = P200

- Projects/Requirements = What’s left.

If you’re curious as to what more ways you can do to save money as a student, read this: How to Save Money as a College Student

Tip#2: Set a Savings/Financial Goal

How can you save when you don’t even know what you’re saving for, right?

It’s important therefore to have a savings/financial goal.

For Florie, she prefers to do the old school method of listing everything in her notebook.

This includes her savings goal and the target date.

She says that this is truly effective because it challenges anyone who does it.

Or, you can even take it up a notch and try popular savings challenges such as the 51 Week Savings Challenge or the Invisible P50 Challenge.

Here are her tips on creating your savings goal:

- Set a goal that’s challenging but realistic.

- Don’t just set your goals. Work hard to achieve it.

You can do put your savings goal in a notebook just like Florie or you can use your phone or any budget app if you prefer!

Tip#3: Open A Savings Account

Even in this time of advanced technologies, there are still Pinoys who prefer to save their money in jars.

This isn’t necessarily bad, but it has more risks than just putting it in the bank.

Florie opened a savings account in a poplar bank when she started saving.

She said that she did so because she didn’t want to be tempted to waste her money.

Now, if you still save in jars, I highly suggest that you put it in a bank soon.

Or if you want your savings to earn higher interest rates than banks, why not try the GSave feature of GCash?

Related: How to Earn Money in GCash (Ultimate Guide!)

Tip#4: Find a Source of Income

If you’re working already, it’s easier to save money than when you’re just a student.

That’s why for students right now, Florie said that it’s important to find a source of income!

For Florie, she has 3 sources of income:

- Allowance

- Business Profits (She profits by selling load to her classmates)

- Scholarships

There are tons of ways to earn money as a student or even as an adult nowadays!

If you don’t want to work outside, why not try online freelancing?

Read these to get started:

- How to Work at Home in the Philippines (Even as a newbie!)

- 7 Steps to Start Working at Home in the Philippines

- 199Jobs Ultimate Guide & Review (How I Made ₱30K!)

Tip#5: Reward Yourself

Another effective tip to help you save money is to reward yourself.

It might sound contradictory but it works!

Florie says that she rewarded herself by traveling once after a semester ended.

She also spends some things here and there.

But the most important thing to remember is to never use all your savings for these. Otherwise, all your hard work would be useless!

To avoid this, I suggest keeping a certain amount of your savings for your rewards.

For instance, you’ve saved P800 this month.

Then, you can set P100-P300 as a reward for your hard work. This money can be spent however you like since you’ve earned it!

Final Thoughts

I hope you were inspired by Florie Mae’s story of how she saved P100 thousand plus at the age of 20!

Aside from that, I hope that her tips helped you as well whether you’re a student or not.

If you want to learn more from Florie Mae, watch and subscribe to her YouTube channel here: Florie Mae

How about you? Don’t be shy to share your savings goals and tips in the comments below!

Read these next:

3 Comments